Authors

Summary

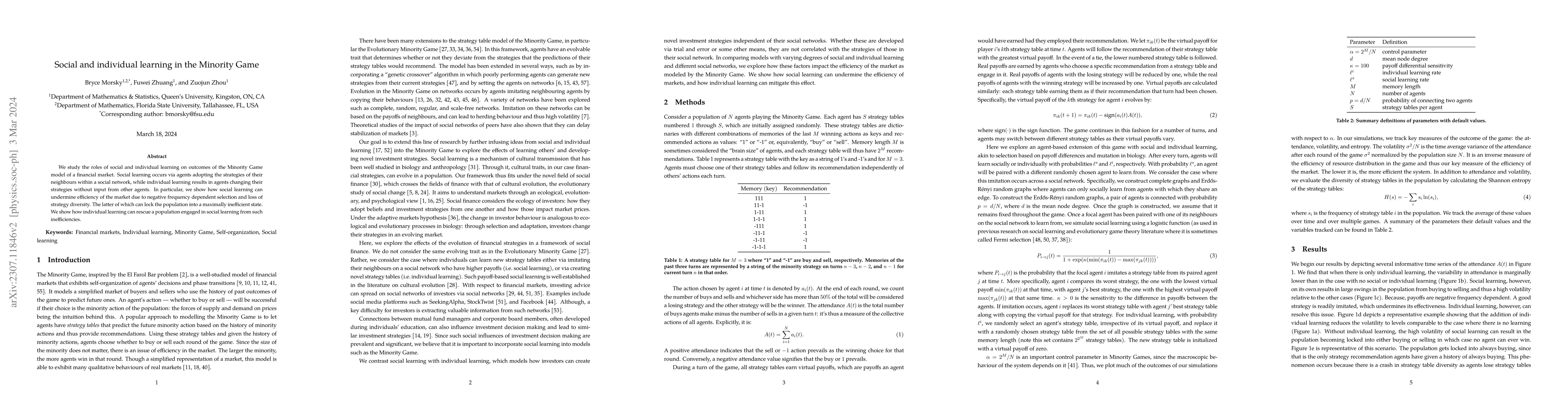

We study the roles of social and individual learning on outcomes of the Minority Game model of a financial market. Social learning occurs via agents adopting the strategies of their neighbours within a social network, while individual learning results in agents changing their strategies without input from other agents. In particular, we show how social learning can undermine efficiency of the market due to negative frequency dependent selection and loss of strategy diversity. The latter of which can lock the population into a maximally inefficient state. We show how individual learning can rescue a population engaged in social learning from such inefficiencies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)