Summary

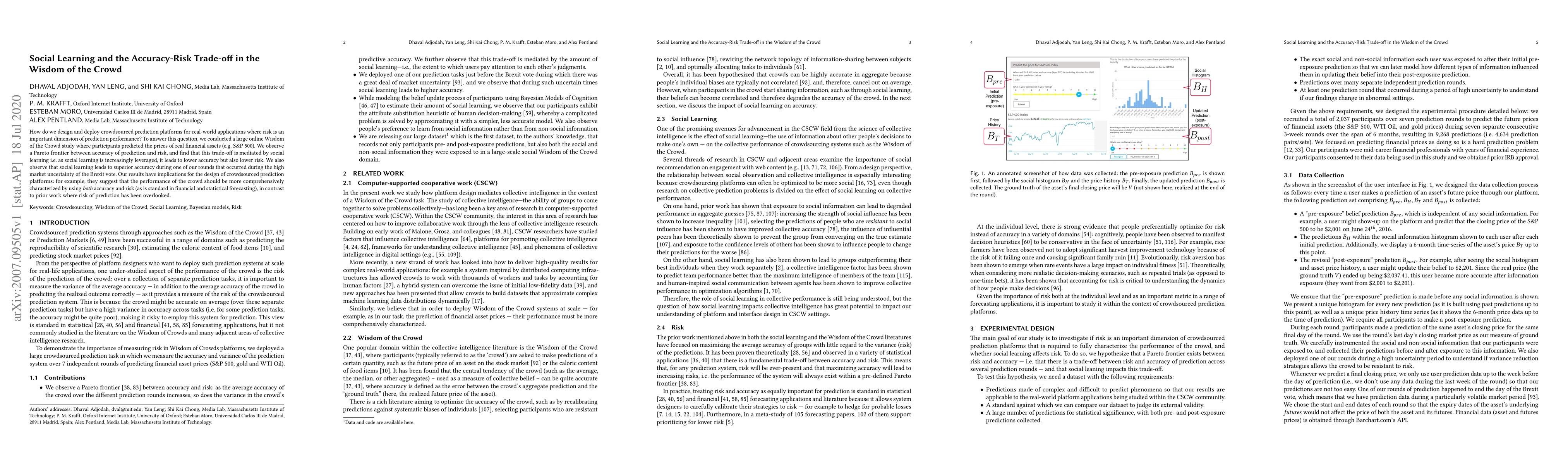

How do we design and deploy crowdsourced prediction platforms for real-world applications where risk is an important dimension of prediction performance? To answer this question, we conducted a large online Wisdom of the Crowd study where participants predicted the prices of real financial assets (e.g. S&P 500). We observe a Pareto frontier between accuracy of prediction and risk, and find that this trade-off is mediated by social learning i.e. as social learning is increasingly leveraged, it leads to lower accuracy but also lower risk. We also observe that social learning leads to superior accuracy during one of our rounds that occurred during the high market uncertainty of the Brexit vote. Our results have implications for the design of crowdsourced prediction platforms: for example, they suggest that the performance of the crowd should be more comprehensively characterized by using both accuracy and risk (as is standard in financial and statistical forecasting), in contrast to prior work where risk of prediction has been overlooked.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersL2B: Learning to Balance the Safety-Efficiency Trade-off in Interactive Crowd-aware Robot Navigation

Follow the Wisdom of the Crowd: Effective Text Generation via Minimum Bayes Risk Decoding

Dan Jurafsky, Mirac Suzgun, Luke Melas-Kyriazi

No citations found for this paper.

Comments (0)