Authors

Summary

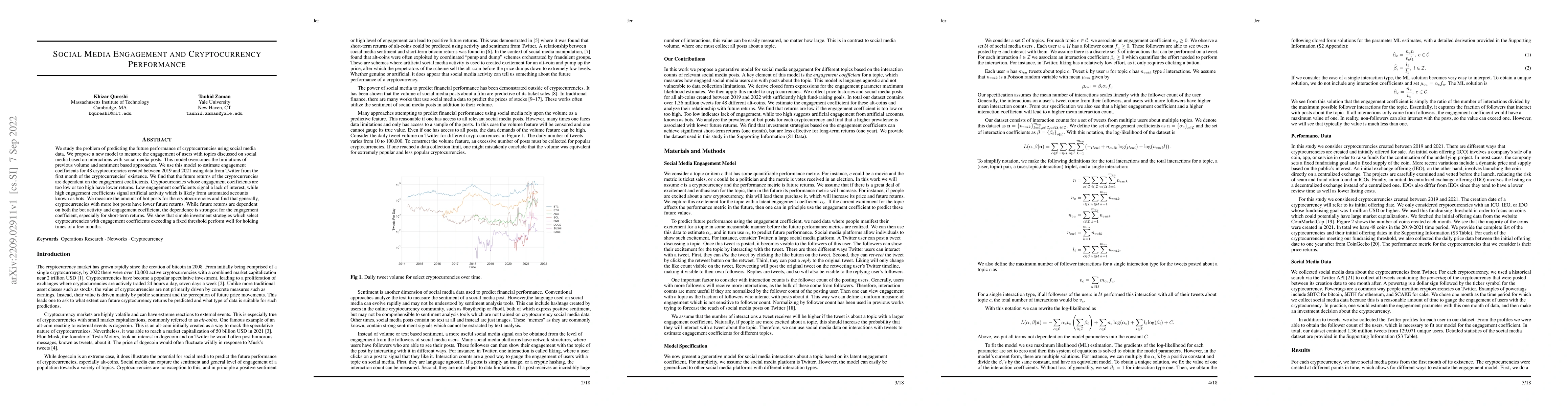

We study the problem of predicting the future performance of cryptocurrencies using social media data. We propose a new model to measure the engagement of users with topics discussed on social media based on interactions with social media posts. This model overcomes the limitations of previous volume and sentiment based approaches. We use this model to estimate engagement coefficients for 48 cryptocurrencies created between 2019 and 2021 using data from Twitter from the first month of the cryptocurrencies' existence. We find that the future returns of the cryptocurrencies are dependent on the engagement coefficients. Cryptocurrencies whose engagement coefficients are too low or too high have lower returns. Low engagement coefficients signal a lack of interest, while high engagement coefficients signal artificial activity which is likely from automated accounts known as bots. We measure the amount of bot posts for the cryptocurrencies and find that generally, cryptocurrencies with more bot posts have lower future returns. While future returns are dependent on both the bot activity and engagement coefficient, the dependence is strongest for the engagement coefficient, especially for short-term returns. We show that simple investment strategies which select cryptocurrencies with engagement coefficients exceeding a fixed threshold perform well for holding times of a few months.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Dataset of Coordinated Cryptocurrency-Related Social Media Campaigns

Tasos Spiliotopoulos, Aad van Moorsel, Karolis Zilius

Analyzing Social Media Engagement of Computer Science Conferences

Sharif Ahmed, Rey Ortiz, Priscilla Salas et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)