Summary

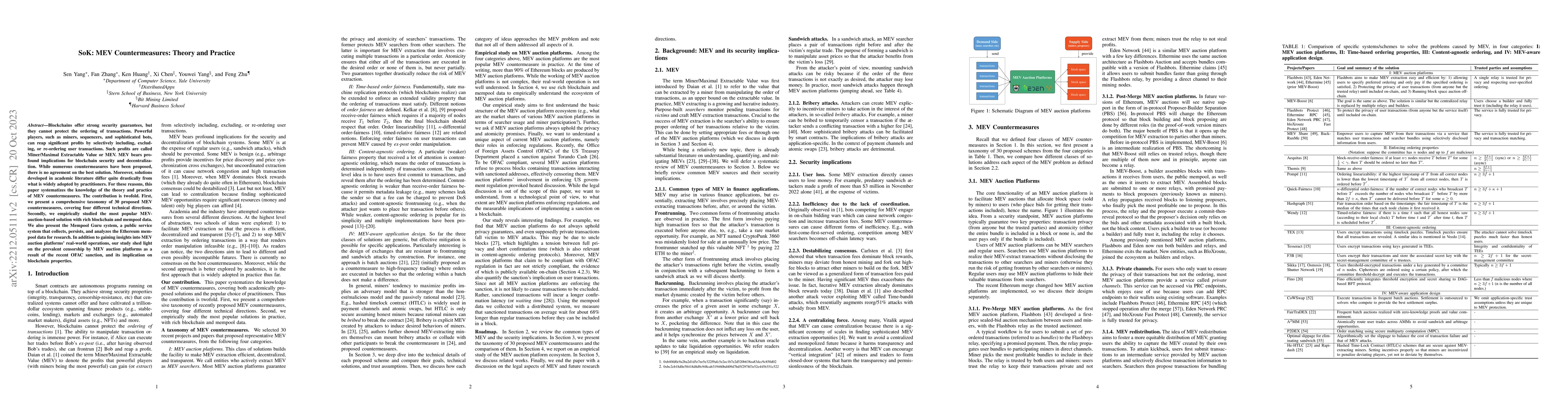

Blockchains offer strong security guarantees, but they cannot protect the ordering of transactions. Powerful players, such as miners, sequencers, and sophisticated bots, can reap significant profits by selectively including, excluding, or re-ordering user transactions. Such profits are called Miner/Maximal Extractable Value or MEV. MEV bears profound implications for blockchain security and decentralization. While numerous countermeasures have been proposed, there is no agreement on the best solution. Moreover, solutions developed in academic literature differ quite drastically from what is widely adopted by practitioners. For these reasons, this paper systematizes the knowledge of the theory and practice of MEV countermeasures. The contribution is twofold. First, we present a comprehensive taxonomy of 30 proposed MEV countermeasures, covering four different technical directions. Secondly, we empirically studied the most popular MEV-auction-based solution with rich blockchain and mempool data. We also present the Mempool Guru system, a public service system that collects, persists, and analyzes the Ethereum mempool data for research. In addition to gaining insights into MEV auction platforms' real-world operations, our study shed light on the prevalent censorship by MEV auction platforms as a result of the recent OFAC sanction, and its implication on blockchain properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSoK: A Systems Perspective on Compound AI Threats and Countermeasures

Anjo Vahldiek-Oberwagner, Mohit Tiwari, Mulong Luo et al.

SoK: Advances and Open Problems in Web Tracking

Nataliia Bielova, Shaoor Munir, Zubair Shafiq et al.

SoK: Machine Learning for Continuous Integration

Triet Huynh Minh Le, Mansooreh Zahedi, Ali Kazemi Arani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)