Authors

Summary

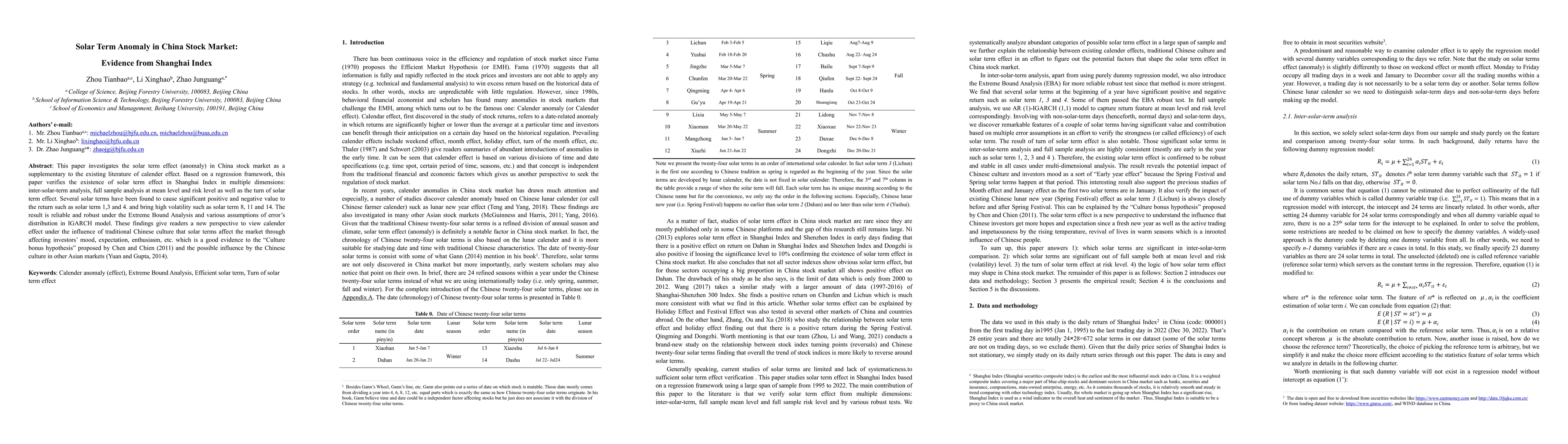

This paper investigates the solar term effect in China stock market as a supplementary to the existing literature of calender effect. Based on a regression framework, this paper verifies the existence of solar term effect in Shanghai Index in multiple dimensions: inter-solar-term analysis, full sample analysis at mean level and risk level as well as the turn of solar term effect. Several solar terms have been found to cause significant positive and negative value to the return such as solar term 1,3 and 4. and bring high volatility such as solar term 8, 11 and 14. The result is reliable and robust under the Extreme Bound Analysis and various assumptions of errors distribution in IGARCH model. These findings give readers a new perspective to view calender effect under the influence of traditional Chinese culture that solar terms affect the market through affecting investors mood, expectation, enthusiasm, etc. which is a good evidence to the Culture bonus hypothesis proposed by Chen and Chien and the possible influence by the Chinese culture in other Asian markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)