Authors

Summary

We study a differential Riccati equation (DRE) with indefinite matrix coefficients, which arises in a wide class of practical problems. We show that the DRE solves an associated control problem, which is key to provide existence and uniqueness of a solution. As an application, we solve two algorithmic trading problems in which the agent adopts a constant absolute risk-aversion (CARA) utility function, and where the optimal strategies use signals and past observations of prices to improve their performance. First, we derive a multi-asset market making strategy in over-the-counter markets, where the market maker uses an external trading venue to hedge risk. Second, we derive an optimal trading strategy that uses prices and signals to learn the drift in the asset prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

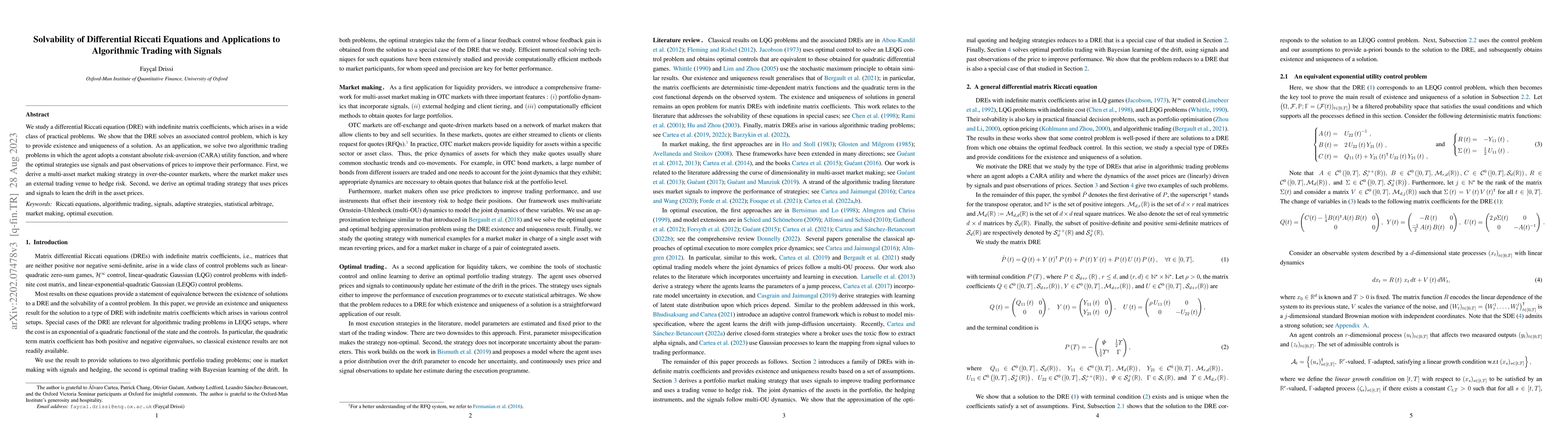

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSolvability of Equilibrium Riccati Equations: A Direct Approach

Bowen Ma, Hanxiao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)