Summary

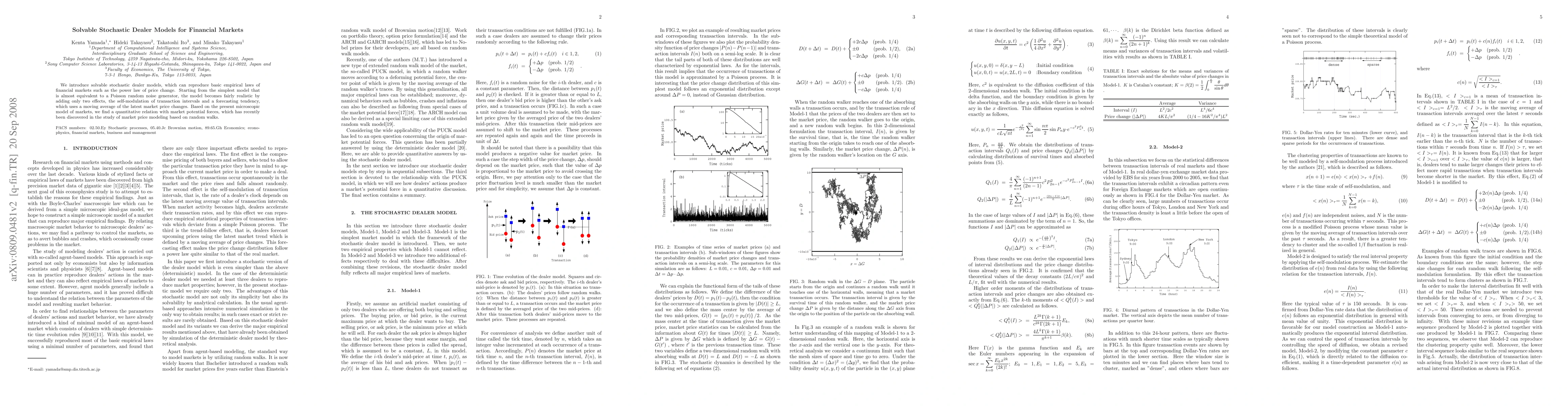

We introduce solvable stochastic dealer models, which can reproduce basic empirical laws of financial markets such as the power law of price change. Starting from the simplest model that is almost equivalent to a Poisson random noise generator, the model becomes fairly realistic by adding only two effects, the self-modulation of transaction intervals and a forecasting tendency, which uses a moving average of the latest market price changes. Based on the present microscopic model of markets, we find a quantitative relation with market potential forces, which has recently been discovered in the study of market price modeling based on random walks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAlgorithmic market making in dealer markets with hedging and market impact

Philippe Bergault, Olivier Guéant, Alexander Barzykin

| Title | Authors | Year | Actions |

|---|

Comments (0)