Summary

In this paper, we aim to solve Bayesian Risk Optimization (BRO), which is a recently proposed framework that formulates simulation optimization under input uncertainty. In order to efficiently solve the BRO problem, we derive nested stochastic gradient estimators and propose corresponding stochastic approximation algorithms. We show that our gradient estimators are asymptotically unbiased and consistent, and that the algorithms converge asymptotically. We demonstrate the empirical performance of the algorithms on a two-sided market model. Our estimators are of independent interest in extending the literature of stochastic gradient estimation to the case of nested risk functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

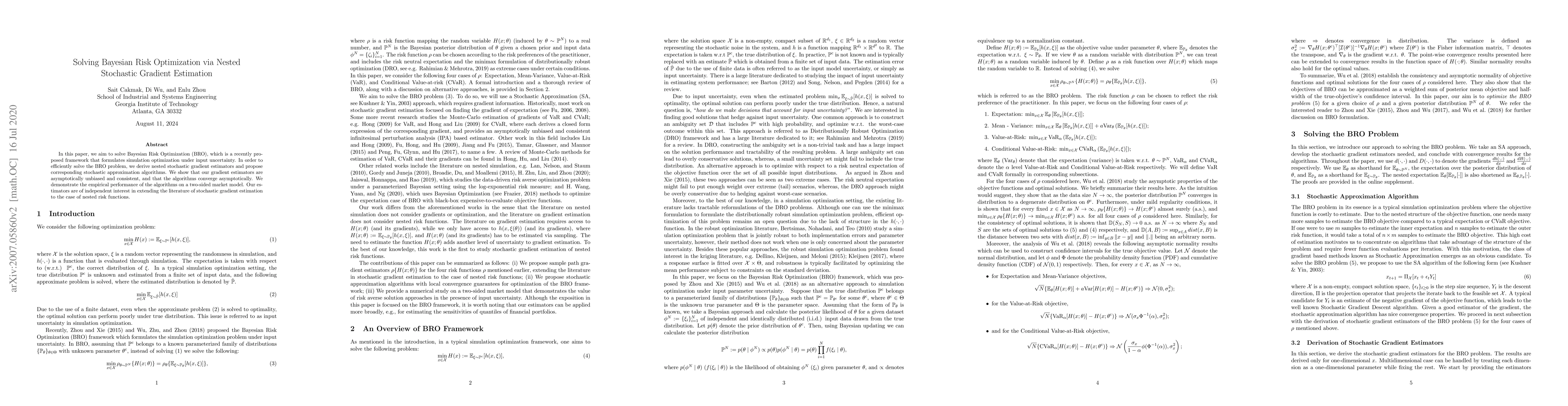

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRiemannian Stochastic Gradient Method for Nested Composition Optimization

Sam Davanloo Tajbakhsh, Dewei Zhang

Nested Stochastic Gradient Descent for (Generalized) Sinkhorn Distance-Regularized Distributionally Robust Optimization

Yi Zhou, Zhaosong Lu, Yufeng Yang

| Title | Authors | Year | Actions |

|---|

Comments (0)