Summary

Quantum annealing has emerged as a powerful tool for solving combinatorial optimization problems efficiently, making use of the principles of quantum mechanics. Companies are increasingly investing in the market of quantum computers, providing the users with the possibility to solve these optimization problems by resorting to quantum computers. This paper explores how Quantum Annealing can be applied to the Currency Arbitrage (CA) optimization problem and its comparative performance against classical methods. A key contribution of the work is an original formulation of the CA problem as a QUBO (Quadratic Unconstrained Boolean Optimization) problem. We test the speed of D-wave quantum annealer, using the recently released latest version (Advantage 2).

AI Key Findings

Generated Oct 01, 2025

Methodology

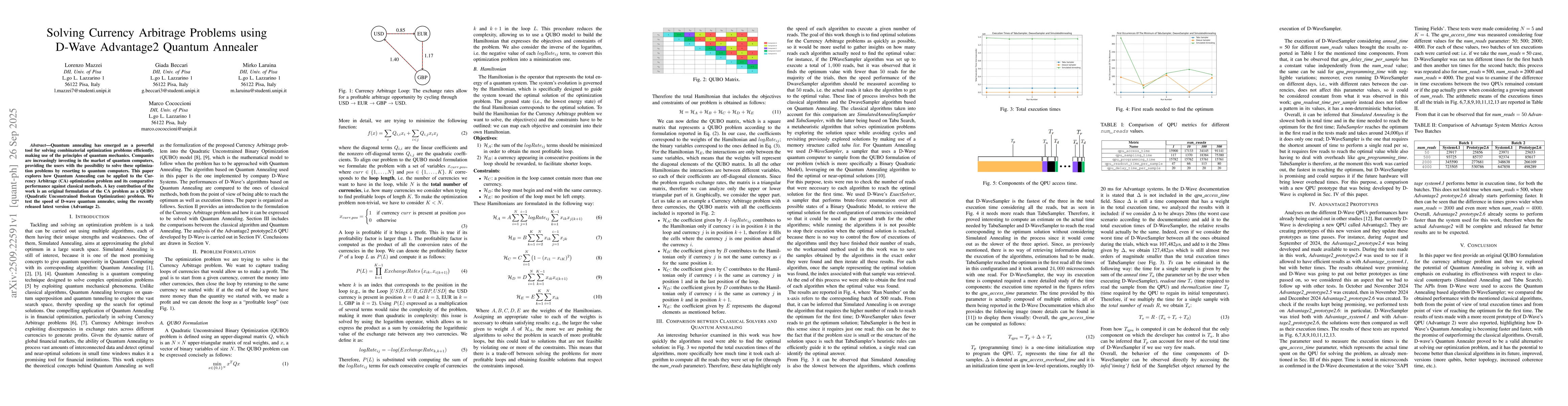

The paper formulates the Currency Arbitrage problem as a Quadratic Unconstrained Binary Optimization (QUBO) problem and uses D-Wave Advantage2 quantum annealer to solve it. It compares the performance of quantum annealing with classical solvers like Simulated Annealing and Tabu Search.

Key Results

- Quantum annealing (D-Wave Sampler) outperformed classical solvers in execution time for large num_reads values, with Advantage2 prototype 2.6 showing faster performance than the older Advantage system 4.1.

- Tabu Sampler reached the optimal solution in a single read, making it the fastest for small problem sizes, while D-Wave Sampler required more reads but had shorter per-read execution times.

- The total execution time for D-Wave Advantage2 decreased with increasing num_reads, indicating potential for scalability and efficiency improvements.

Significance

This research demonstrates the viability of quantum annealing for solving complex financial optimization problems like currency arbitrage, which could lead to faster and more efficient trading strategies in financial markets.

Technical Contribution

The paper introduces a novel QUBO formulation for currency arbitrage that incorporates both profitability and constraint satisfaction, enabling the use of quantum annealing for this type of optimization problem.

Novelty

This work is novel in its application of quantum annealing to currency arbitrage, along with the specific formulation of the problem as a QUBO and the detailed comparison with classical optimization techniques.

Limitations

- The study's results are based on specific hardware prototypes (Advantage2) and may not generalize to future quantum annealer versions.

- The comparison with classical solvers was limited to a specific set of problem sizes and configurations, which may not represent all real-world scenarios.

Future Work

- Further testing with larger and more complex currency arbitrage problems to validate scalability.

- Exploring hybrid approaches combining quantum and classical solvers for better performance.

- Investigating the impact of future quantum hardware improvements on the efficiency of quantum annealing for financial optimization.

Paper Details

PDF Preview

Similar Papers

Found 5 papersCurrency Arbitrage Optimization using Quantum Annealing, QAOA and Constraint Mapping

Frank Mueller, Sangram Deshpande, Elin Ranjan Das

Comments (0)