Summary

Nowadays many financial derivatives, such as American or Bermudan options, are of early exercise type. Often the pricing of early exercise options gives rise to high-dimensional optimal stopping problems, since the dimension corresponds to the number of underlying assets. High-dimensional optimal stopping problems are, however, notoriously difficult to solve due to the well-known curse of dimensionality. In this work, we propose an algorithm for solving such problems, which is based on deep learning and computes, in the context of early exercise option pricing, both approximations of an optimal exercise strategy and the price of the considered option. The proposed algorithm can also be applied to optimal stopping problems that arise in other areas where the underlying stochastic process can be efficiently simulated. We present numerical results for a large number of example problems, which include the pricing of many high-dimensional American and Bermudan options, such as Bermudan max-call options in up to 5000 dimensions. Most of the obtained results are compared to reference values computed by exploiting the specific problem design or, where available, to reference values from the literature. These numerical results suggest that the proposed algorithm is highly effective in the case of many underlyings, in terms of both accuracy and speed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

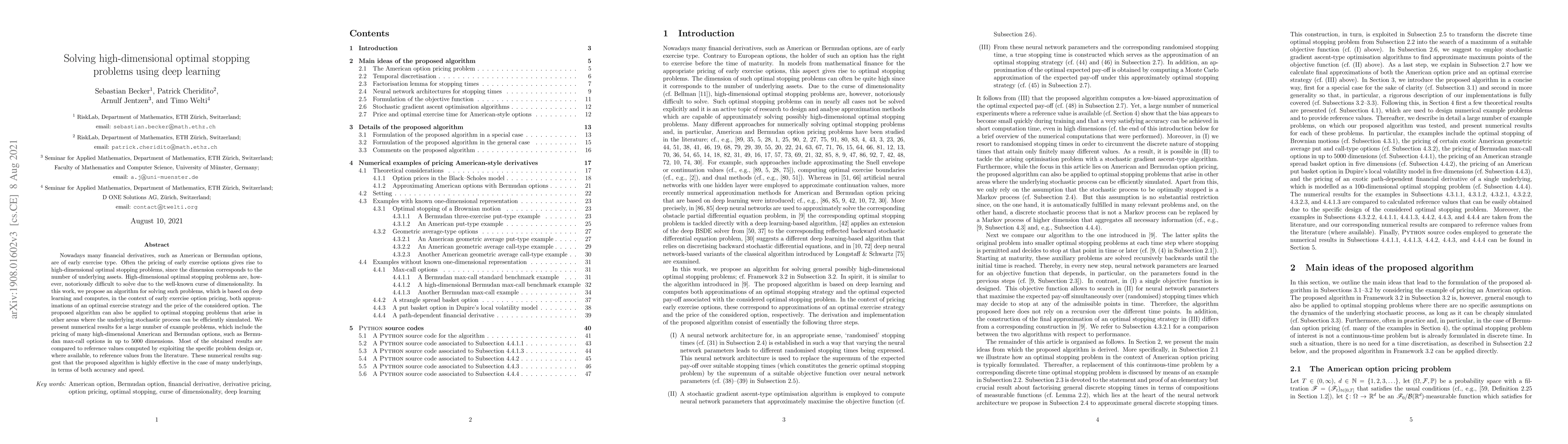

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)