Authors

Summary

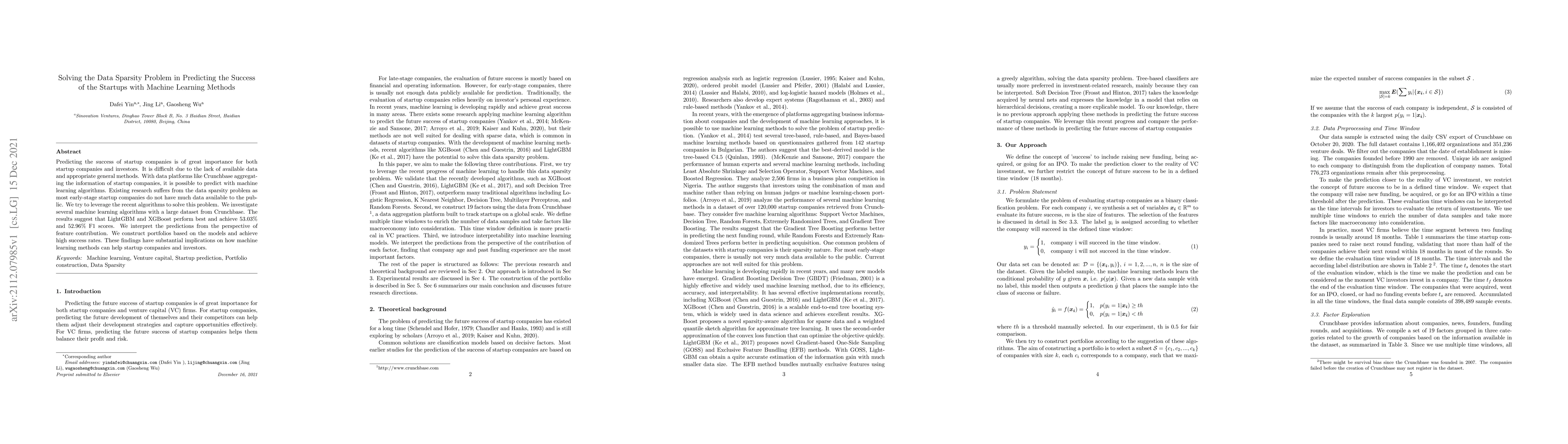

Predicting the success of startup companies is of great importance for both startup companies and investors. It is difficult due to the lack of available data and appropriate general methods. With data platforms like Crunchbase aggregating the information of startup companies, it is possible to predict with machine learning algorithms. Existing research suffers from the data sparsity problem as most early-stage startup companies do not have much data available to the public. We try to leverage the recent algorithms to solve this problem. We investigate several machine learning algorithms with a large dataset from Crunchbase. The results suggest that LightGBM and XGBoost perform best and achieve 53.03% and 52.96% F1 scores. We interpret the predictions from the perspective of feature contribution. We construct portfolios based on the models and achieve high success rates. These findings have substantial implications on how machine learning methods can help startup companies and investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMachine Learning Methods in Solving the Boolean Satisfiability Problem

Yaohui Jin, Junchi Yan, Wenxuan Guo et al.

The Science of Startups: The Impact of Founder Personalities on Company Success

Marian-Andrei Rizoiu, Xian Gong, Paul X. McCarthy et al.

Analysis of Software Engineering Practices in General Software and Machine Learning Startups

Nasir U. Eisty, Bishal Lakha, Kalyan Bhetwal

| Title | Authors | Year | Actions |

|---|

Comments (0)