Summary

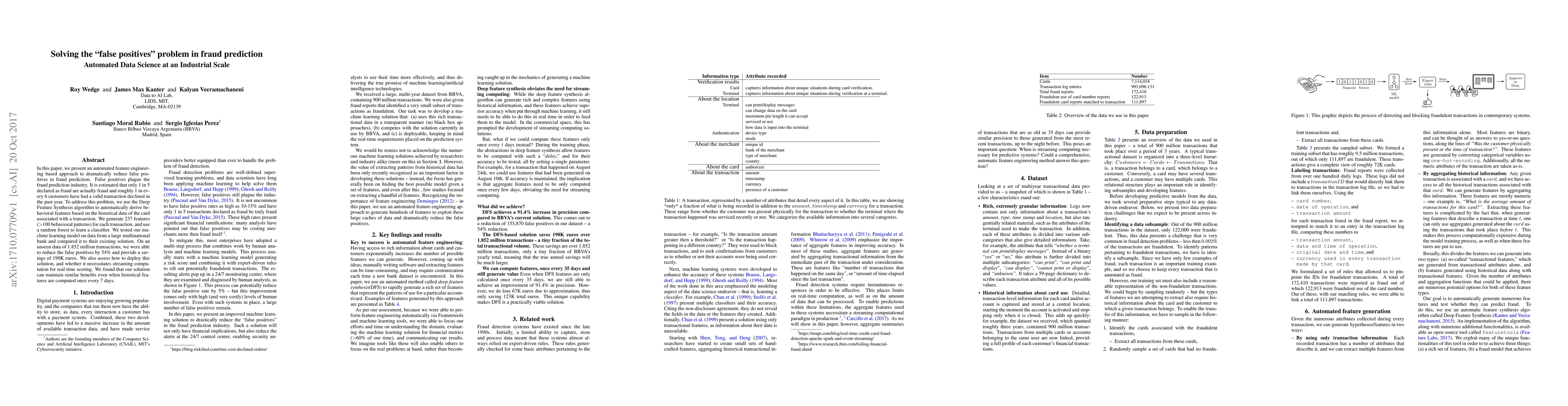

In this paper, we present an automated feature engineering based approach to dramatically reduce false positives in fraud prediction. False positives plague the fraud prediction industry. It is estimated that only 1 in 5 declared as fraud are actually fraud and roughly 1 in every 6 customers have had a valid transaction declined in the past year. To address this problem, we use the Deep Feature Synthesis algorithm to automatically derive behavioral features based on the historical data of the card associated with a transaction. We generate 237 features (>100 behavioral patterns) for each transaction, and use a random forest to learn a classifier. We tested our machine learning model on data from a large multinational bank and compared it to their existing solution. On an unseen data of 1.852 million transactions, we were able to reduce the false positives by 54% and provide a savings of 190K euros. We also assess how to deploy this solution, and whether it necessitates streaming computation for real time scoring. We found that our solution can maintain similar benefits even when historical features are computed once every 7 days.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersConformal Prediction Sets with Limited False Positives

Tommi Jaakkola, Tal Schuster, Adam Fisch et al.

Examining False Positives under Inference Scaling for Mathematical Reasoning

Liang Wang, Yu Wang, Furu Wei et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)