Summary

The possibility of re-switching of techniques in Piero Sraffa's intersectoral model, namely the returning capital-intensive techniques with monotonic changes in the profit rate, is traditionally considered as a paradox putting at stake the viability of the neoclassical theory of production. It is argued here that this phenomenon can be rationalized within the neoclassical paradigm. Sectoral interdependencies can give rise to non-monotonic effects of progressive variations in income distribution on relative prices. The re-switching of techniques is, therefore, the result of cost-minimizing technical choices facing returning ranks of relative input prices in full consistency with the neoclassical perspective.

AI Key Findings

Generated Sep 06, 2025

Methodology

A critical analysis of Sraffian models using Garegnani's 1976 example

Key Results

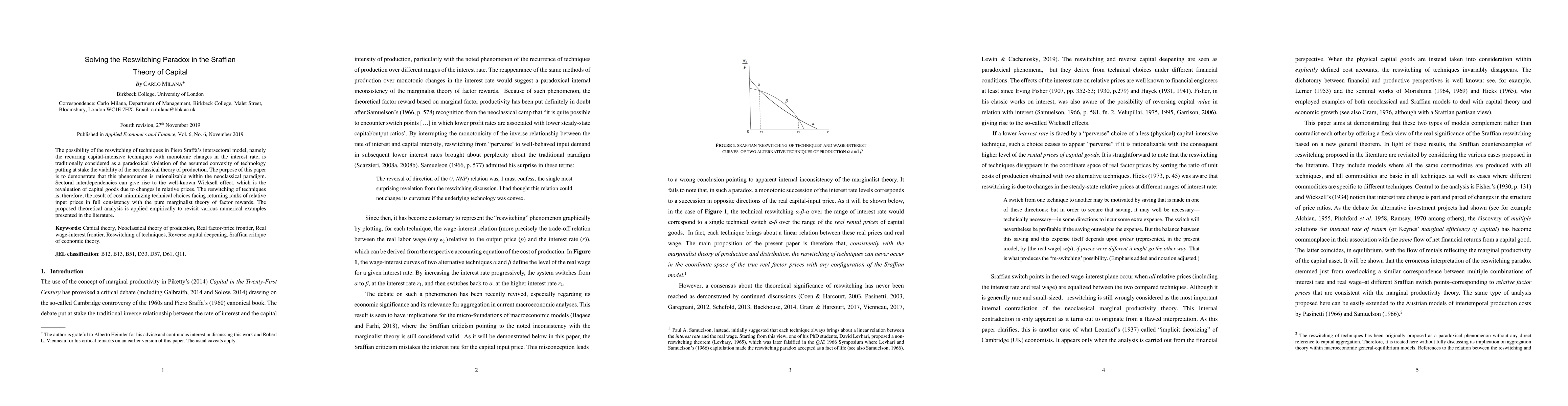

- The reswitching paradox is resolved by considering non-linear effects on relative prices

- Monotonic changes in interest rate lead to monotonic changes in techniques

- Relative factor intensities and prices are negatively related

Significance

This research contributes to our understanding of the neoclassical paradigm and its implications for technical choices

Technical Contribution

A new solution to the reswitching paradox using non-linear factor price effects

Novelty

This research provides a novel interpretation of Sraffian models and their implications for economic theory

Limitations

- The analysis is limited to stationary equilibrium with no capital depreciation

- The model assumes homogeneous capital goods across techniques

Future Work

- Investigating the effects of capital depreciation on relative prices

- Extending the analysis to include heterogeneous capital goods and multiple sectors

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)