Summary

Securitization has become prevalent in many countries, and has substantial impact on government monetary policy and fiscal policy which have not yet been adequately analyzed in the existing literature. This article develops optimal conditions for efficient securitization, identifies constraints on securitization, and analyzes the interactions of capital-reserve requirements and securitization. This article introduces new decision models and theories of asset-securitization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

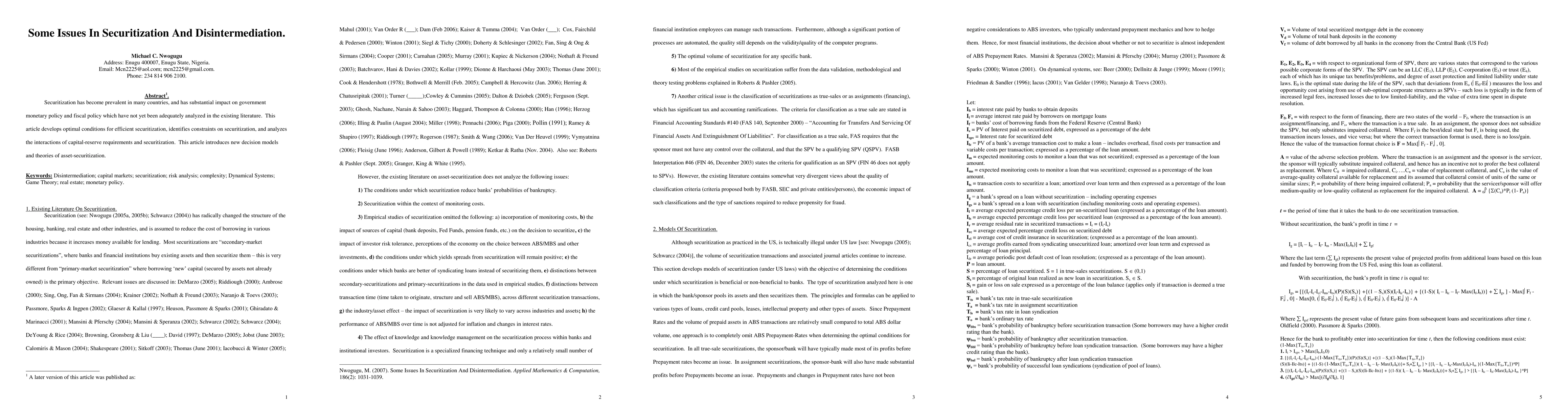

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMortgage Securitization Dynamics in the Aftermath of Natural Disasters: A Reply

Amine Ouazad, Matthew E. Kahn

Flattening Supply Chains: When do Technology Improvements lead to Disintermediation?

Meena Jagadeesan, Nicole Immorlica, Brendan Lucier et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)