Authors

Summary

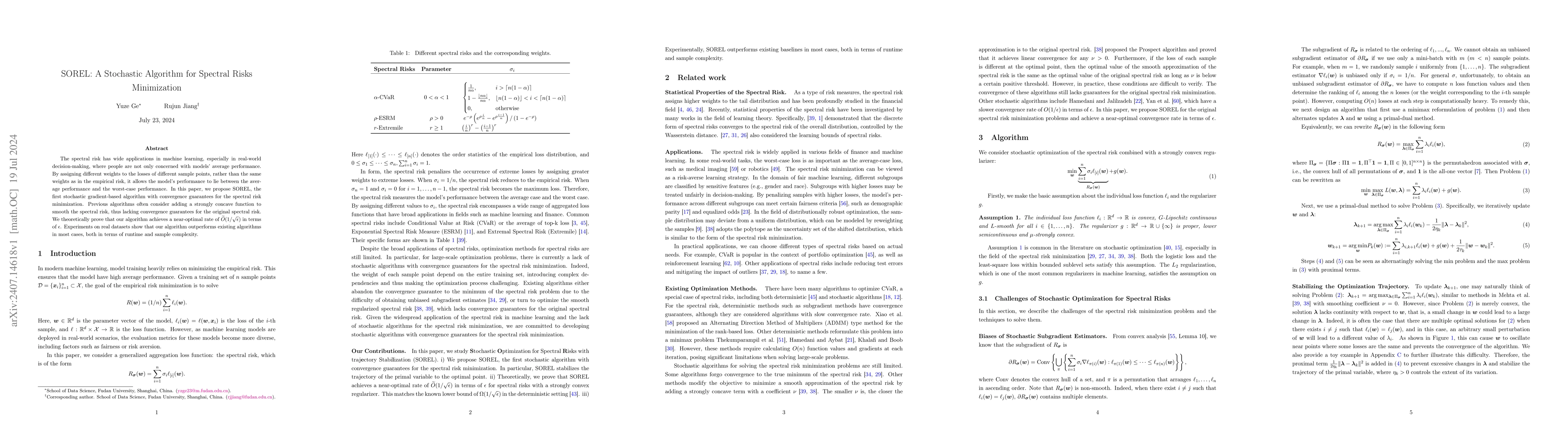

The spectral risk has wide applications in machine learning, especially in real-world decision-making, where people are not only concerned with models' average performance. By assigning different weights to the losses of different sample points, rather than the same weights as in the empirical risk, it allows the model's performance to lie between the average performance and the worst-case performance. In this paper, we propose SOREL, the first stochastic gradient-based algorithm with convergence guarantees for the spectral risk minimization. Previous algorithms often consider adding a strongly concave function to smooth the spectral risk, thus lacking convergence guarantees for the original spectral risk. We theoretically prove that our algorithm achieves a near-optimal rate of $\widetilde{O}(1/\sqrt{\epsilon})$ in terms of $\epsilon$. Experiments on real datasets show that our algorithm outperforms existing algorithms in most cases, both in terms of runtime and sample complexity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSOReL and TOReL: Two Methods for Fully Offline Reinforcement Learning

Michael A. Osborne, Mattie Fellows, Jakob N. Foerster et al.

Accelerated Doubly Stochastic Gradient Algorithm for Large-scale Empirical Risk Minimization

Chao Zhang, Hui Qian, Zebang Shen et al.

Stochastic Optimization for Spectral Risk Measures

Krishna Pillutla, Vincent Roulet, Zaid Harchaoui et al.

No citations found for this paper.

Comments (0)