Authors

Summary

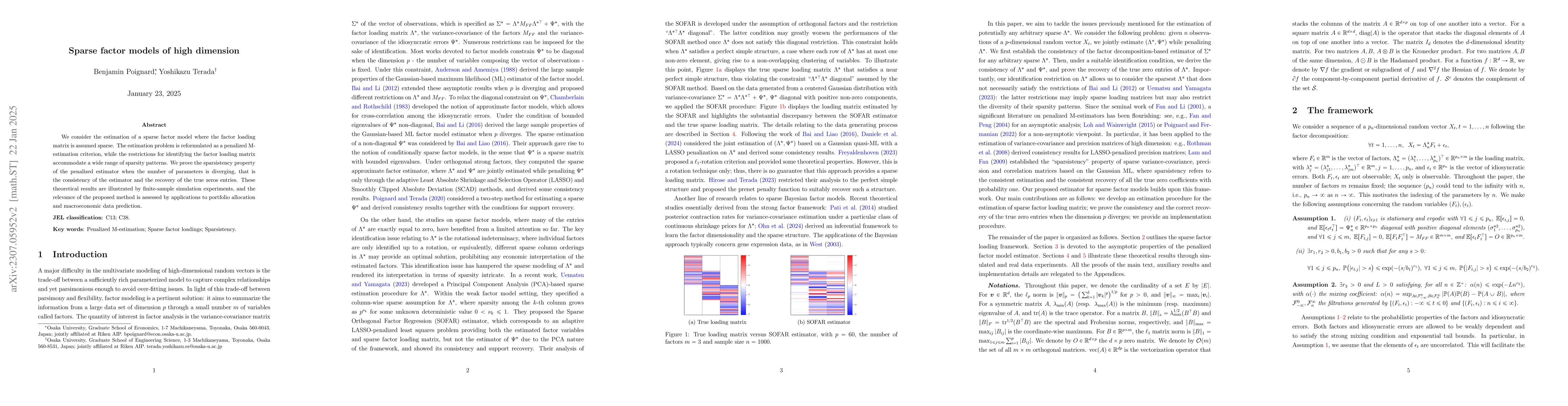

We consider the estimation of factor model-based variance-covariance matrix when the factor loading matrix is assumed sparse. To do so, we rely on a system of penalized estimating functions to account for the identification issue of the factor loading matrix while fostering sparsity in potentially all its entries. We prove the oracle property of the penalized estimator for the factor model when the dimension is fixed. That is, the penalization procedure can recover the true sparse support, and the estimator is asymptotically normally distributed. Consistency and recovery of the true zero entries are established when the number of parameters is diverging. These theoretical results are supported by simulation experiments, and the relevance of the proposed method is illustrated by an application to portfolio allocation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFactor multivariate stochastic volatility models of high dimension

Benjamin Poignard, Manabu Asai

Bridging factor and sparse models

Jianqing Fan, Ricardo Masini, Marcelo C. Medeiros

| Title | Authors | Year | Actions |

|---|

Comments (0)