Summary

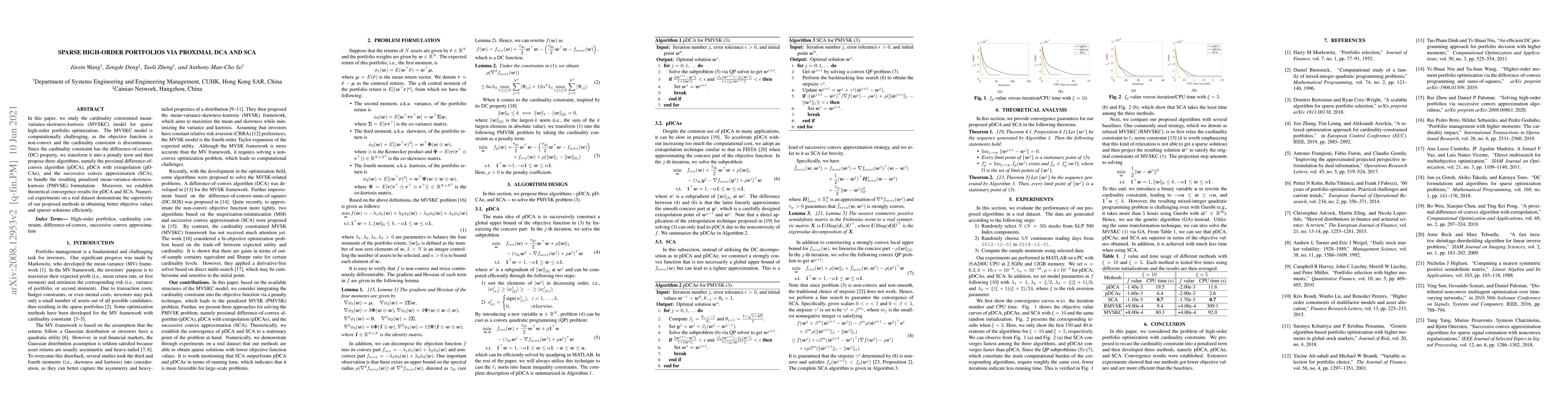

In this paper, we aim at solving the cardinality constrained high-order portfolio optimization, i.e., mean-variance-skewness-kurtosis model with cardinality constraint (MVSKC). Optimization for the MVSKC model is of great difficulty in two parts. One is that the objective function is non-convex, the other is the combinational nature of the cardinality constraint, leading to non-convexity as well dis-continuity. Based on the observation that cardinality constraint has the difference-of-convex (DC) property, we transform the cardinality constraint into a penalty term and then propose three algorithms including the proximal difference of convex algorithm (pDCA), pDCA with extrapolation (pDCAe) and the successive convex approximation (SCA) to handle the resulting penalized MVSK (PMVSK) formulation. Moreover, theoretical convergence results of these algorithms are established respectively. Numerical experiments on the real datasets demonstrate the superiority of our proposed methods in obtaining high utility and sparse solutions as well as efficiency in terms of time usage.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSparse and Low-Rank High-Order Tensor Regression via Parallel Proximal Method

Zhaoyang Wang, Jiaqi Zhang, Yinghao Cai et al.

Sparse spanning portfolios and under-diversification with second-order stochastic dominance

Olivier Scaillet, Stelios Arvanitis, Nikolas Topaloglou

| Title | Authors | Year | Actions |

|---|

Comments (0)