Summary

This paper considers a high-dimensional linear regression problem where there are complex correlation structures among predictors. We propose a graph-constrained regularization procedure, named Sparse Laplacian Shrinkage with the Graphical Lasso Estimator (SLS-GLE). The procedure uses the estimated precision matrix to describe the specific information on the conditional dependence pattern among predictors, and encourages both sparsity on the regression model and the graphical model. We introduce the Laplacian quadratic penalty adopting the graph information, and give detailed discussions on the advantages of using the precision matrix to construct the Laplacian matrix. Theoretical properties and numerical comparisons are presented to show that the proposed method improves both model interpretability and accuracy of estimation. We also apply this method to a financial problem and prove that the proposed procedure is successful in assets selection.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

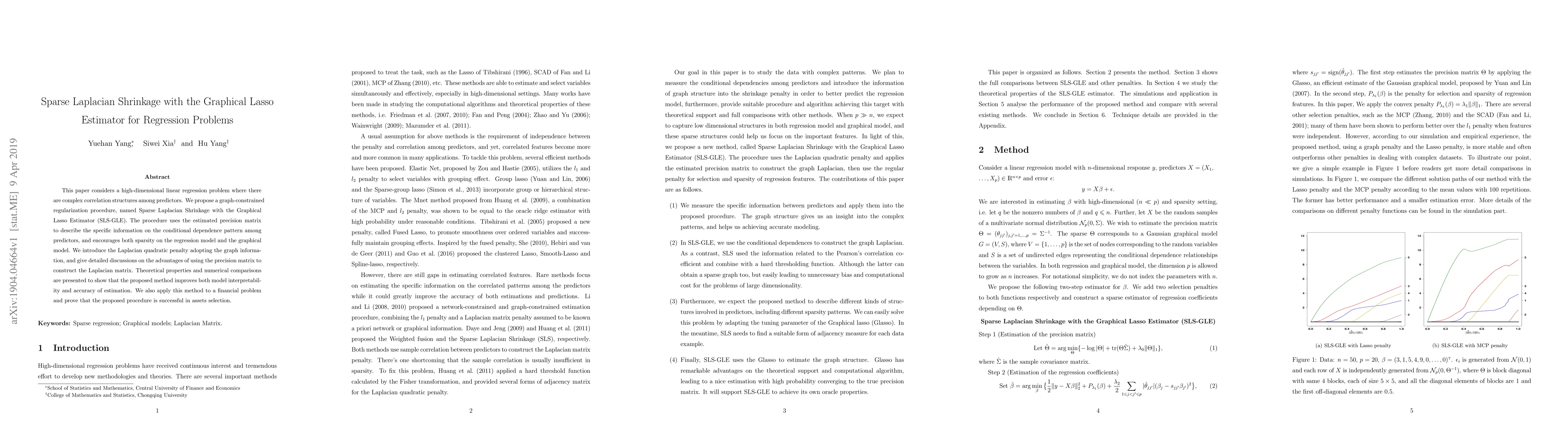

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSparse Private LASSO Logistic Regression

Edward Raff, Fred Lu, Amol Khanna et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)