Summary

In this paper, we propose $\ell_p$-norm regularized models to seek near-optimal sparse portfolios. These sparse solutions reduce the complexity of portfolio implementation and management. Theoretical results are established to guarantee the sparsity of the second-order KKT points of the $\ell_p$-norm regularized models. More interestingly, we present a theory that relates sparsity of the KKT points with Projected correlation and Projected Sharpe ratio. We also design an interior point algorithm to obtain an approximate second-order KKT solution of the $\ell_p$-norm models in polynomial time with a fixed error tolerance, and then test our $\ell_p$-norm modes on S&P 500 (2008-2012) data and international market data.\ The computational results illustrate that the $\ell_p$-norm regularized models can generate portfolios of any desired sparsity with portfolio variance and portfolio return comparable to those of the unregularized Markowitz model with cardinality constraint. Our analysis of a combined model lead us to conclude that sparsity is not directly related to overfitting at all. Instead, we find that sparsity moderates overfitting only indirectly. A combined $\ell_1$-$\ell_p$ model shows that the proper choose of leverage, which is the amount of additional buying-power generated by selling short can mitigate overfitting; A combined $\ell_2$-$\ell_p$ model is able to produce extremely high performing portfolios that exceeded the 1/N strategy and all $\ell_1$ and $\ell_2$ regularized portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

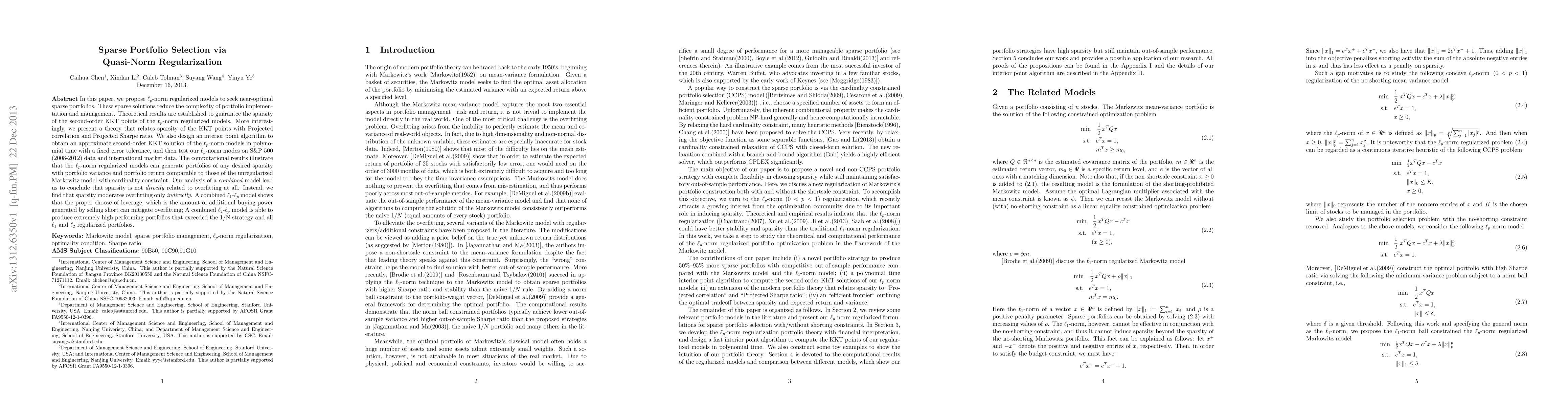

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)