Summary

This paper aims to examine the use of sparse methods to forecast the real, in the chain-linked volume sense, expenditure components of the US and EU GDP in the short-run sooner than the national institutions of statistics officially release the data. We estimate current quarter nowcasts along with 1- and 2-quarter forecasts by bridging quarterly data with available monthly information announced with a much smaller delay. We solve the high-dimensionality problem of the monthly dataset by assuming sparse structures of leading indicators, capable of adequately explaining the dynamics of analyzed data. For variable selection and estimation of the forecasts, we use the sparse methods - LASSO together with its recent modifications. We propose an adjustment that combines LASSO cases with principal components analysis that deemed to improve the forecasting performance. We evaluate forecasting performance conducting pseudo-real-time experiments for gross fixed capital formation, private consumption, imports and exports over the sample of 2005-2019, compared with benchmark ARMA and factor models. The main results suggest that sparse methods can outperform the benchmarks and to identify reasonable subsets of explanatory variables. The proposed LASSO-PC modification show further improvement in forecast accuracy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

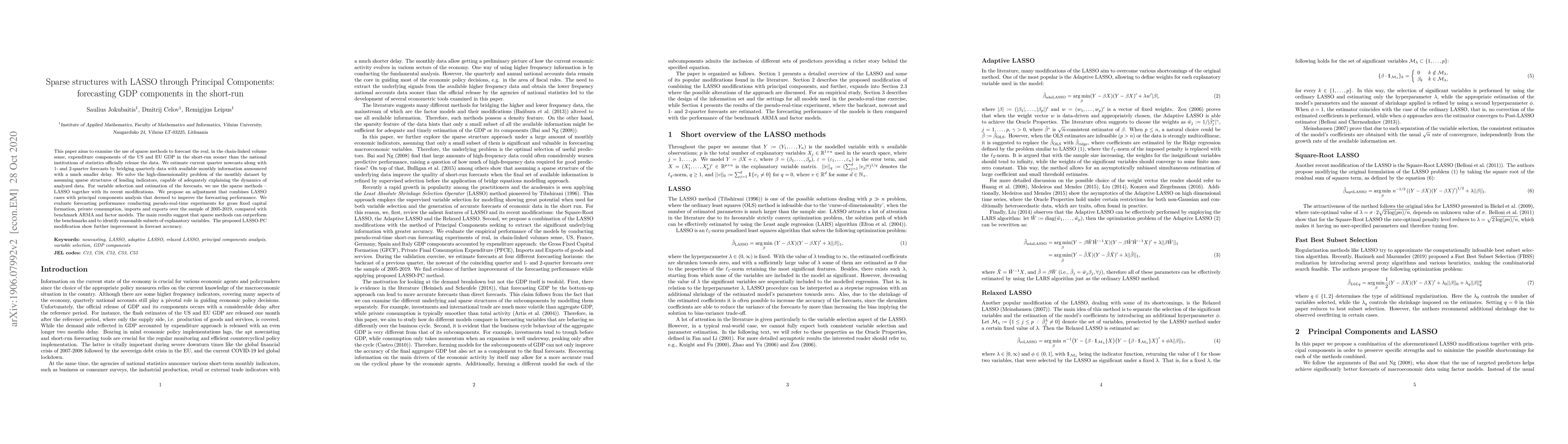

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)