Authors

Summary

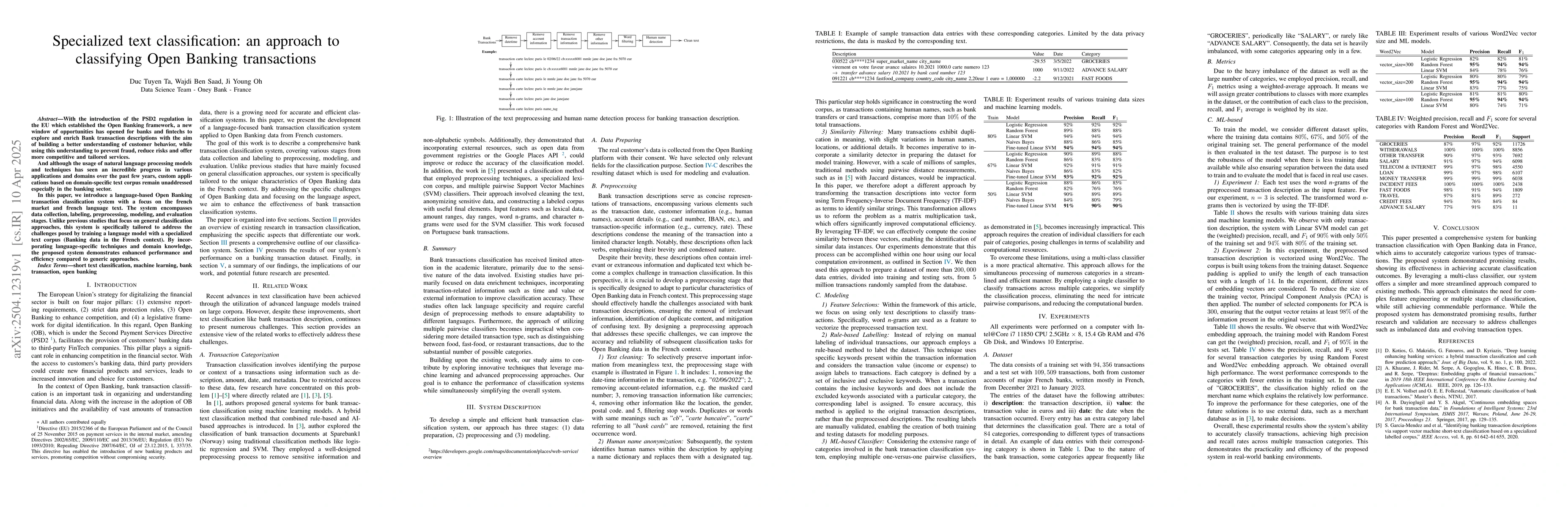

With the introduction of the PSD2 regulation in the EU which established the Open Banking framework, a new window of opportunities has opened for banks and fintechs to explore and enrich Bank transaction descriptions with the aim of building a better understanding of customer behavior, while using this understanding to prevent fraud, reduce risks and offer more competitive and tailored services. And although the usage of natural language processing models and techniques has seen an incredible progress in various applications and domains over the past few years, custom applications based on domain-specific text corpus remain unaddressed especially in the banking sector. In this paper, we introduce a language-based Open Banking transaction classification system with a focus on the french market and french language text. The system encompasses data collection, labeling, preprocessing, modeling, and evaluation stages. Unlike previous studies that focus on general classification approaches, this system is specifically tailored to address the challenges posed by training a language model with a specialized text corpus (Banking data in the French context). By incorporating language-specific techniques and domain knowledge, the proposed system demonstrates enhanced performance and efficiency compared to generic approaches.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research introduces a language-based Open Banking transaction classification system for the French market, focusing on banking data specificity and language nuances. It involves data collection, labeling, preprocessing, modeling, and evaluation stages, utilizing advanced preprocessing techniques and a multi-class classifier for efficiency.

Key Results

- The system demonstrates enhanced performance and efficiency compared to generic approaches by incorporating language-specific techniques and domain knowledge.

- Experiments show that the system can achieve high precision, recall, and F1 scores (up to 95%) with only 50% of the training data.

- The proposed method simplifies the classification process, eliminating the need for complex feature engineering or multiple classification stages.

- The system effectively classifies various transaction categories, including 'GROCERIES', 'WITHDRAWALS', 'OTHER TRANSFERS', 'SALARY', 'TELECOM & INTERNET', 'LOAN', 'MONEY TRANSFER', 'INCIDENT FEES', 'FAST FOOD', 'TRAVEL', 'CREDIT FEES', and 'ADVANCESALARY'.

Significance

This research is significant as it addresses the under-explored domain of specialized text classification in banking, particularly for Open Banking data in the French context. It aims to improve fraud prevention, risk reduction, and tailored services by accurately categorizing transactions, thereby contributing to the digitalization of the financial sector in the EU.

Technical Contribution

The main technical contribution of this work is a tailored, language-based Open Banking transaction classification system that effectively leverages advanced preprocessing techniques and a multi-class classifier for improved performance and efficiency compared to generic approaches.

Novelty

This research distinguishes itself by focusing on the unique challenges of training a language model with a specialized text corpus (banking data in the French context), incorporating language-specific techniques, and employing a multi-class classifier to simplify the classification process.

Limitations

- The study is limited to the French language and market, so its applicability to other languages and markets remains unexplored.

- The dataset used for training and testing might not cover all possible transaction types and scenarios, potentially limiting generalizability.

Future Work

- Investigate the applicability of the proposed method to other languages and markets to expand its utility.

- Explore the integration of additional data sources, such as external merchant databases, to improve classification accuracy for less frequent transaction categories.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIdentifying Banking Transaction Descriptions via Support Vector Machine Short-Text Classification Based on a Specialized Labelled Corpus

Silvia García-Méndez, Francisco J. González-Castaño, Milagros Fernández-Gavilanes et al.

Network Analysis of Global Banking Systems and Detection of Suspicious Transactions

Anthony Bonato, Adam Szava, Juan Chavez Palan

No citations found for this paper.

Comments (0)