Summary

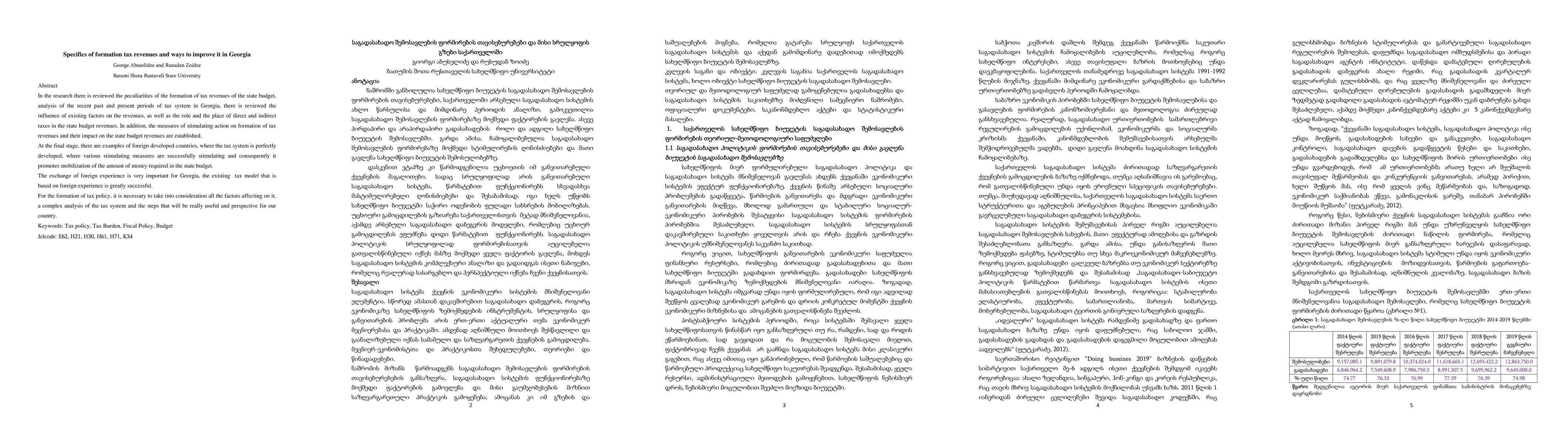

In the research there is reviewed the peculiarities of the formation of tax revenues of the state budget, analysis of the recent past and present periods of tax system in Georgia, there is reviewed the influence of existing factors on the revenues, as well as the role and the place of direct and indirect taxes in the state budget revenues. In addition, the measures of stimulating action on formation of tax revenues and their impact on the state budget revenues are established. At the final stage, there are examples of foreign developed countries, where the tax system is perfectly developed, where various stimulating measures are successfully stimulating and consequently it promotes mobilization of the amount of money required in the state budget. The exchange of foreign experience is very important for Georgia, the existing tax model that is based on foreign experience is greatly successful. For the formation of tax policy, it is necessary to take into consideration all the factors affecting on it, a complex analysis of the tax system and the steps that will be really useful and perspective for our country.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProblems of Tax Administration and its Impact on Budget Revenues

Marika Ormotsadze

Forecasting pandemic tax revenues in a small, open economy

Fabio Ashtar Telarico

No citations found for this paper.

Comments (0)