Summary

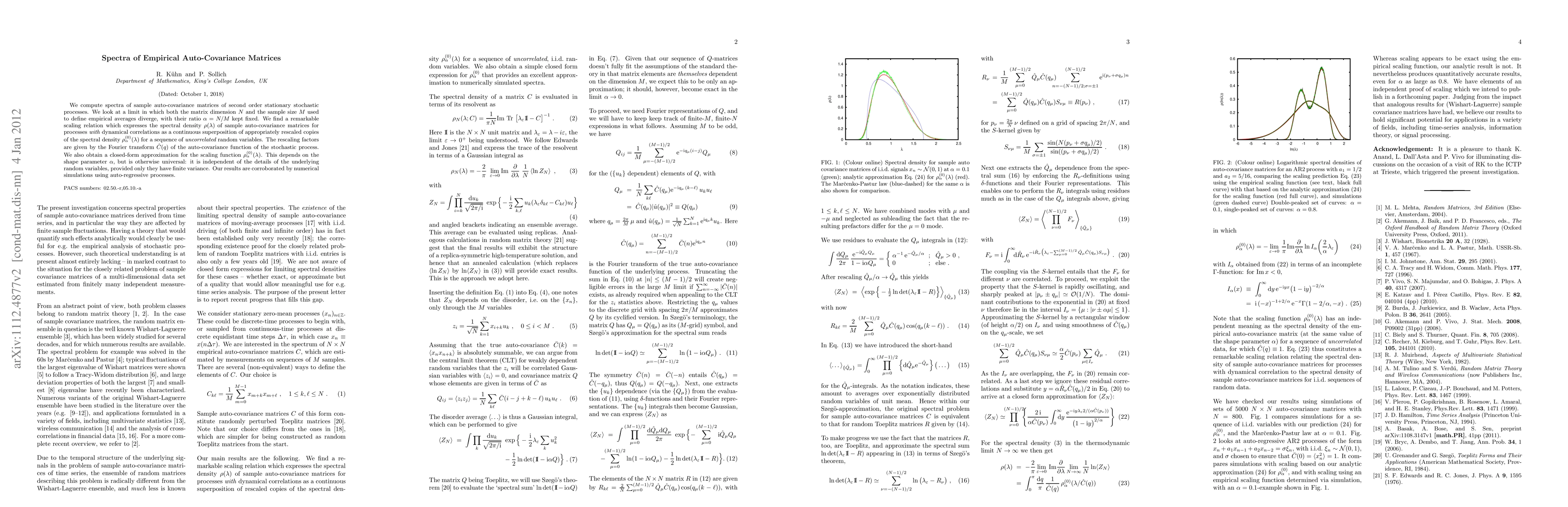

We compute spectra of sample auto-covariance matrices of second order stationary stochastic processes. We look at a limit in which both the matrix dimension $N$ and the sample size $M$ used to define empirical averages diverge, with their ratio $\alpha=N/M$ kept fixed. We find a remarkable scaling relation which expresses the spectral density $\rho(\lambda)$ of sample auto-covariance matrices for processes with dynamical correlations as a continuous superposition of appropriately rescaled copies of the spectral density $\rho^{(0)}_\alpha(\lambda)$ for a sequence of uncorrelated random variables. The rescaling factors are given by the Fourier transform $\hat C(q)$ of the auto-covariance function of the stochastic process. We also obtain a closed-form approximation for the scaling function $\rho^{(0)}_\alpha(\lambda)$. This depends on the shape parameter $\alpha$, but is otherwise universal: it is independent of the details of the underlying random variables, provided only they have finite variance. Our results are corroborated by numerical simulations using auto-regressive processes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBulk Spectra of Truncated Sample Covariance Matrices

Soumendu Sundar Mukherjee, Subhroshekhar Ghosh, Himasish Talukdar

| Title | Authors | Year | Actions |

|---|

Comments (0)