Summary

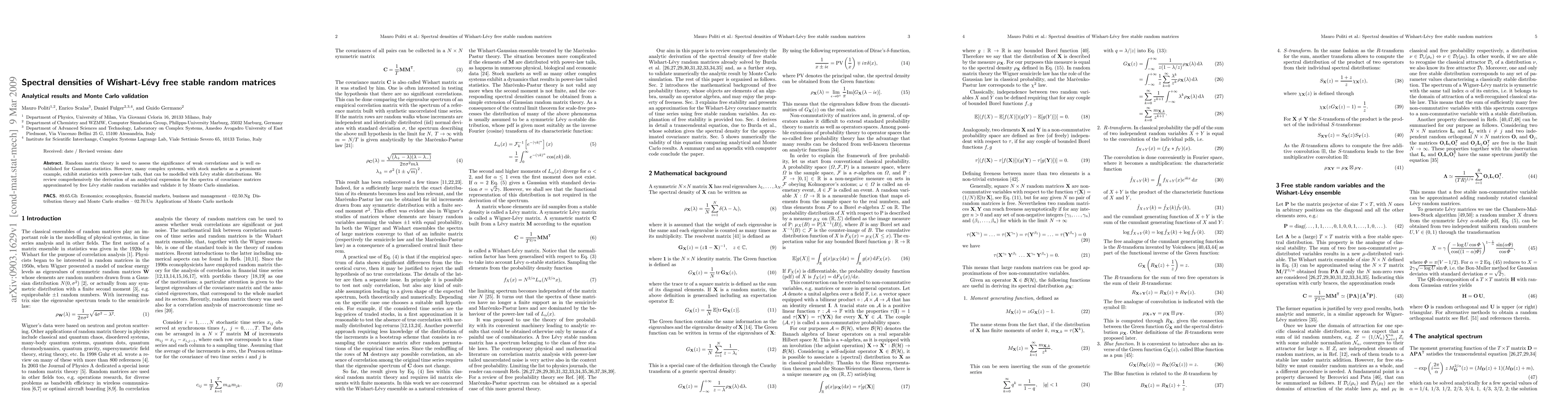

Random matrix theory is used to assess the significance of weak correlations and is well established for Gaussian statistics. However, many complex systems, with stock markets as a prominent example, exhibit statistics with power-law tails, that can be modelled with Levy stable distributions. We review comprehensively the derivation of an analytical expression for the spectra of covariance matrices approximated by free Levy stable random variables and validate it by Monte Carlo simulation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)