Authors

Summary

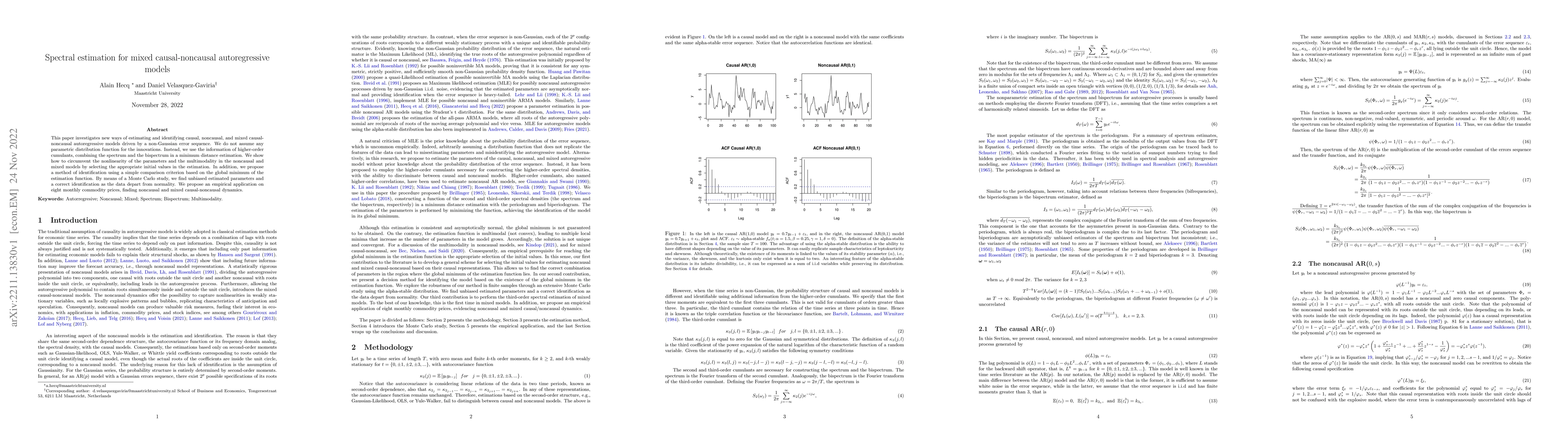

This paper investigates new ways of estimating and identifying causal, noncausal, and mixed causal-noncausal autoregressive models driven by a non-Gaussian error sequence. We do not assume any parametric distribution function for the innovations. Instead, we use the information of higher-order cumulants, combining the spectrum and the bispectrum in a minimum distance estimation. We show how to circumvent the nonlinearity of the parameters and the multimodality in the noncausal and mixed models by selecting the appropriate initial values in the estimation. In addition, we propose a method of identification using a simple comparison criterion based on the global minimum of the estimation function. By means of a Monte Carlo study, we find unbiased estimated parameters and a correct identification as the data depart from normality. We propose an empirical application on eight monthly commodity prices, finding noncausal and mixed causal-noncausal dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpectral identification and estimation of mixed causal-noncausal invertible-noninvertible models

Alain Hecq, Daniel Velasquez-Gaviria

Nonlinear Fore(Back)casting and Innovation Filtering for Causal-Noncausal VAR Models

Christian Gourieroux, Joann Jasiak

Detecting common bubbles in multivariate mixed causal-noncausal models

Gianluca Cubadda, Alain Hecq, Elisa Voisin

Inference in mixed causal and noncausal models with generalized Student's t-distributions

Francesco Giancaterini, Alain Hecq

| Title | Authors | Year | Actions |

|---|

Comments (0)