Summary

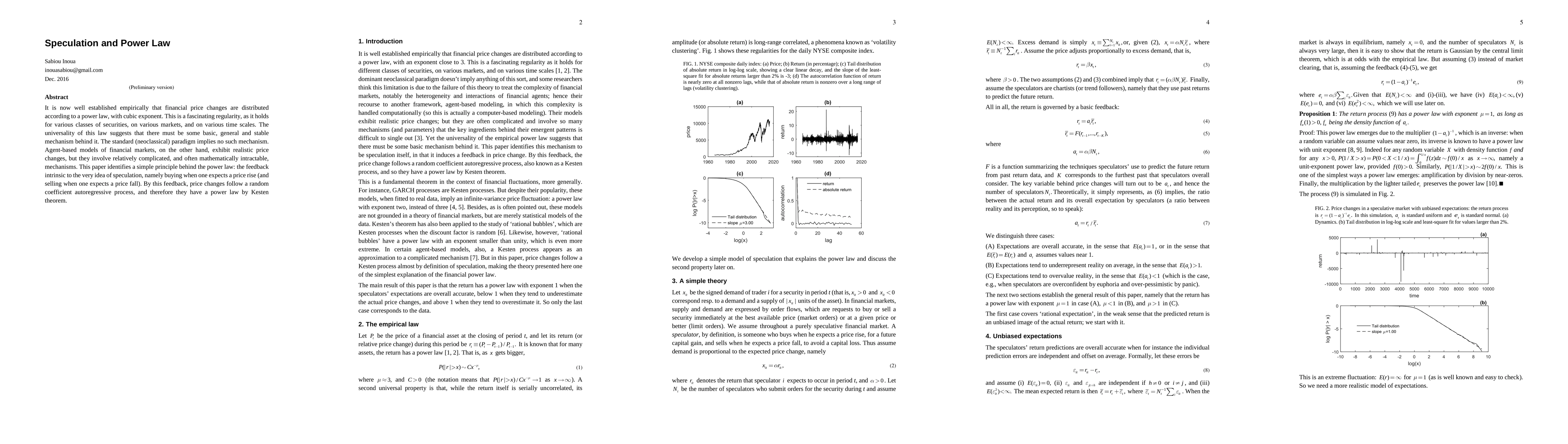

It is now well established empirically that financial price changes are distributed according to a power law, with cubic exponent. This is a fascinating regularity, as it holds for various classes of securities, on various markets, and on various time scales. The universality of this law suggests that there must be some basic, general and stable mechanism behind it. The standard (neoclassical) paradigm implies no such mechanism. Agent-based models of financial markets, on the other hand, exhibit realistic price changes, but they involve relatively complicated, and often mathematically intractable, mechanisms. This paper identifies a simple principle behind the power law: the feedback intrinsic to the very idea of speculation, namely buying when one expects a price rise (and selling when one expects a price fall). By this feedback, price changes follow a random coefficient autoregressive process, and therefore they have a power law by Kesten theorem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)