Summary

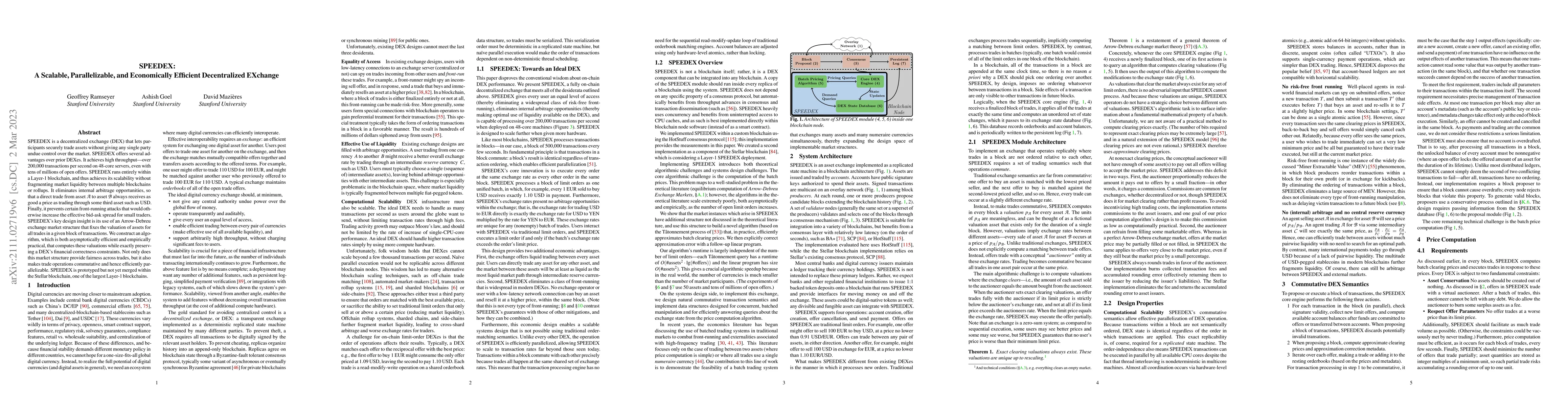

SPEEDEX is a decentralized exchange (DEX) that lets participants securely trade assets without giving any single party undue control over the market. SPEEDEX offers several advantages over prior DEXes. It achieves high throughput -- over 200,000 transactions per second on 48-core servers, even with tens of millions of open offers. SPEEDEX runs entirely within a Layer-1 blockchain, and thus achieves its scalability without fragmenting market liquidity between multiple blockchains or rollups. It eliminates internal arbitrage opportunities, so that a direct trade from asset $\mathcal{A}$ to asset $\mathcal{B}$ always receives as good a price as trading through some third asset such as USD. Finally, it prevents certain front-running attacks that would otherwise increase the effective bid-ask spread for small traders. SPEEDEX's key design insight is its use of an Arrow-Debreu exchange market structure that fixes the valuation of assets for all trades in a given block of transactions. We construct an algorithm, which is both asymptotically efficient and empirically practical, that computes these valuations while exactly preserving a DEX's financial correctness constraints. Not only does this market structure provide fairness across trades, but it also makes trade operations commutative and hence efficiently parallelizable. SPEEDEX is prototyped but not yet merged within the Stellar blockchain, one of the largest Layer-1 blockchains.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)