Authors

Summary

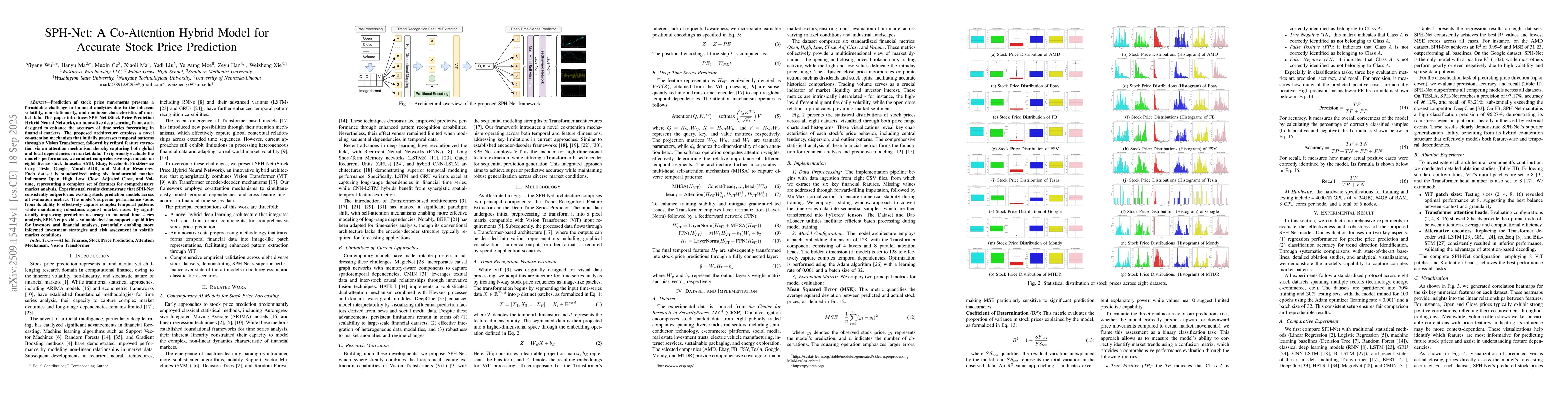

Prediction of stock price movements presents a formidable challenge in financial analytics due to the inherent volatility, non-stationarity, and nonlinear characteristics of market data. This paper introduces SPH-Net (Stock Price Prediction Hybrid Neural Network), an innovative deep learning framework designed to enhance the accuracy of time series forecasting in financial markets. The proposed architecture employs a novel co-attention mechanism that initially processes temporal patterns through a Vision Transformer, followed by refined feature extraction via an attention mechanism, thereby capturing both global and local dependencies in market data. To rigorously evaluate the model's performance, we conduct comprehensive experiments on eight diverse stock datasets: AMD, Ebay, Facebook, FirstService Corp, Tesla, Google, Mondi ADR, and Matador Resources. Each dataset is standardized using six fundamental market indicators: Open, High, Low, Close, Adjusted Close, and Volume, representing a complete set of features for comprehensive market analysis. Experimental results demonstrate that SPH-Net consistently outperforms existing stock prediction models across all evaluation metrics. The model's superior performance stems from its ability to effectively capture complex temporal patterns while maintaining robustness against market noise. By significantly improving prediction accuracy in financial time series analysis, SPH-Net provides valuable decision-support capabilities for investors and financial analysts, potentially enabling more informed investment strategies and risk assessment in volatile market conditions.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research introduces SPH-Net, a hybrid neural network integrating Vision Transformer (ViT) and Transformer encoder-decoder with co-attention mechanisms. It transforms stock price data into image-like formats for enhanced feature extraction and trend recognition through extensive experiments on eight real-world stock datasets.

Key Results

- SPH-Net consistently outperforms state-of-the-art models in both regression and classification tasks with superior R2 scores, reduced MSE, and improved classification metrics.

- The co-attention mechanism enables effective extraction of discriminative features from highly correlated financial variables, enhancing cross-domain generalization.

- SPH-Net effectively mitigates prediction latency artifacts from LSTM and avoids oversmoothing tendencies of ARIMA models through its hybrid architecture.

Significance

This research provides a robust framework for financial time-series forecasting with enhanced prediction accuracy and interpretability, addressing critical challenges in stock price prediction and offering practical value for real-world applications.

Technical Contribution

The technical contribution lies in the co-attention-based integration of ViT and Transformer, creating a hybrid architecture that effectively captures both local and global temporal dependencies in financial time-series data.

Novelty

The novelty of this work is the combination of Vision Transformer for fine-grained pattern extraction with Transformer for temporal dependency modeling, along with the co-attention mechanism that enhances feature discrimination and cross-domain generalization capabilities.

Limitations

- The model's performance may be affected by the quality and completeness of the input data, particularly for datasets with irregular distributions like Google's dataset.

- The complexity of the hybrid architecture may pose challenges for real-time deployment and scalability in large-scale financial systems.

Future Work

- Incorporating additional data modalities such as financial news and sentiment analysis to improve contextual understanding.

- Extending the model to handle intra-day or high-frequency trading data for more granular market predictions.

- Developing lightweight versions of SPH-Net for real-time systems and integrating explainable AI techniques to enhance decision-making transparency.

Paper Details

PDF Preview

Similar Papers

Found 5 papersAttention-based CNN-LSTM and XGBoost hybrid model for stock prediction

Jian Wu, Yang Hu, Zhuangwei Shi et al.

Stock Market Price Prediction: A Hybrid LSTM and Sequential Self-Attention based Approach

Ahmed M. Abdelmoniem, Sukhpal Singh Gill, Karan Pardeshi

Comments (0)