Authors

Summary

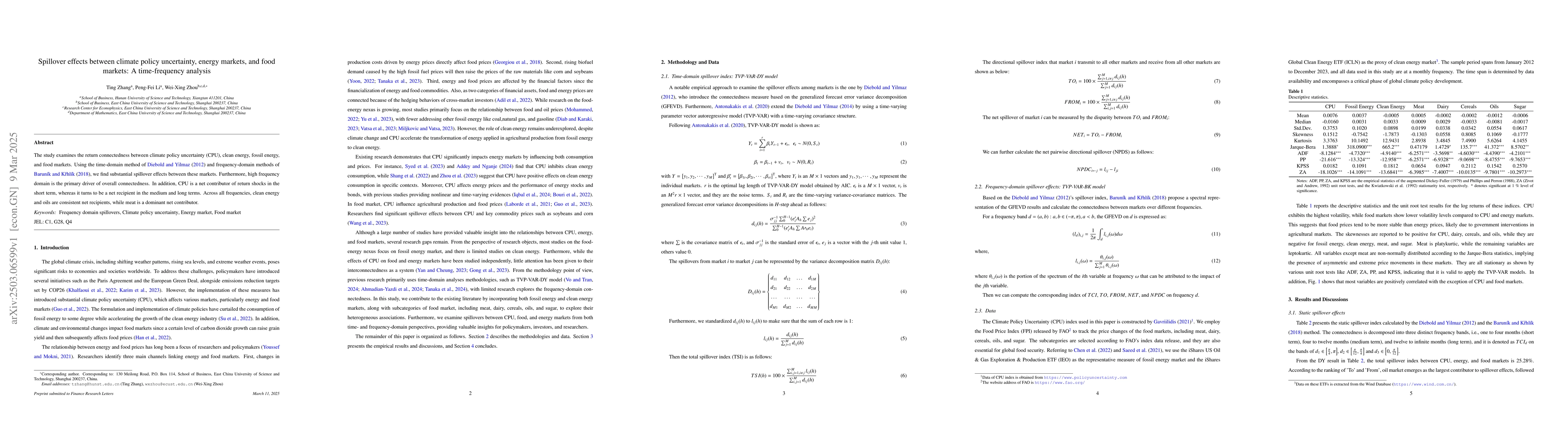

The study examines the return connectedness between climate policy uncertainty (CPU), clean energy, fossil energy, and food markets. Using the time-domain method of Diebold and Yilmaz (2012) and frequency-domain methods of Barun{\'{i}}k and K{\v{r}}hl{\'{i}}k (2018), we find substantial spillover effects between these markets. Furthermore, high frequency domain is the primary driver of overall connectedness. In addition, CPU is a net contributor of return shocks in the short term, whereas it turns to be a net recipient in the medium and long terms. Across all frequencies, clean energy and oils are consistent net recipients, while meat is a dominant net contributor.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study uses time-domain method of Diebold and Yilmaz (2012) and frequency-domain methods of Baruník and Krhlik (2018) to analyze return connectedness among climate policy uncertainty (CPU), clean energy, fossil energy, and food markets.

Key Results

- Substantial spillover effects between CPU, energy, and food markets are found, with high-frequency domain driving overall connectedness.

- CPU acts as a net contributor in the short term, but turns into a net recipient in medium and long terms.

- Across all frequencies, clean energy and oils are net recipients, while meat is a dominant net contributor.

- Oil market is the largest contributor and recipient of spillover effects in both short, medium, and long terms.

- Dynamic analysis highlights persistent significance of spillover effects, peaking at the end of 2012 and declining steadily afterward.

Significance

This research provides insights for policymakers by reminding them to prevent short-term risk transmission from CPU to energy and food markets, and aids investors by informing them about the frequency-dependent return spillovers.

Technical Contribution

The paper introduces a time-frequency analysis of spillover effects, combining Diebold and Yilmaz (2012) and Baruník and Krhlik (2018) methodologies, to study the interconnections among CPU, energy, and food markets.

Novelty

This work distinguishes itself by examining the spillover effects from both time and frequency perspectives, highlighting the importance of high-frequency connectedness and the evolving roles of CPU and meat markets as net recipients over time.

Limitations

- The study is based on U.S. CPU data, limiting its applicability to other countries.

- No consideration of potential asymmetric effects or non-linear relationships in the analysis.

Future Work

- Extend the analysis by incorporating CPU data from other countries, such as China and Australia.

- Investigate heterogeneous relationships between CPU, food, and energy markets in different countries.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSpillover Effects of US Monetary Policy on Emerging Markets Amidst Uncertainty

Povilas Lastauskas, Anh Dinh Minh Nguyen

The impact of external uncertainties on the extreme return connectedness between food, fossil energy, and clean energy markets

Ting Zhang, Wei-Xing Zhou, Hai-Chuan Xu

The resilience of China's financial markets: With a focus on the impact of its climate policy uncertainty

Si-yao Wei, Wei-xing Zhou

Tail dependence structure and extreme risk spillover effects between the international agricultural futures and spot markets

Wei-Xing Zhou, Yun-Shi Dai, Peng-Fei Dai

No citations found for this paper.

Comments (0)