Summary

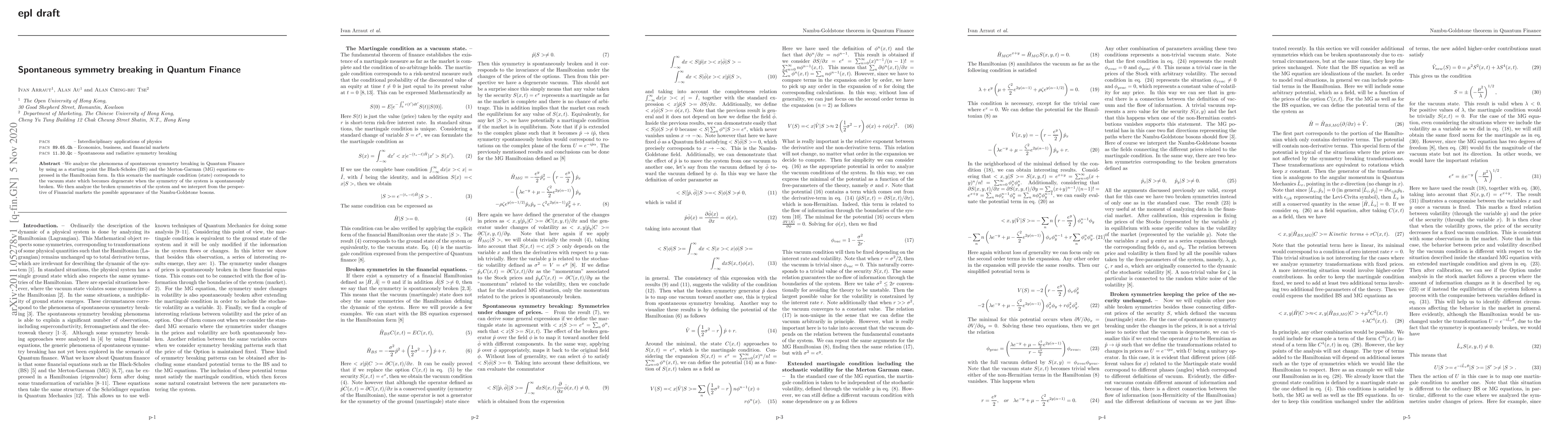

We analyze the phenomena of spontaneous symmetry breaking in Quantum Finance by using as a starting point the Black-Scholes (BS) and the Merton-Garman (MG) equations expressed in the Hamiltonian form. In this scenario the martingale condition (state) corresponds to the vacuum state which becomes degenerate when the symmetry of the system is spontaneously broken. We then analyze the broken symmetries of the system and we interpret from the perspective of Financial markets the possible appearance of the Nambu-Goldstone bosons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe probability flow in the Stock market and Spontaneous symmetry breaking in Quantum Finance

Ivan Arraut, Joao Alexandre Lobo Marques, Sergio Gomes

| Title | Authors | Year | Actions |

|---|

Comments (0)