Summary

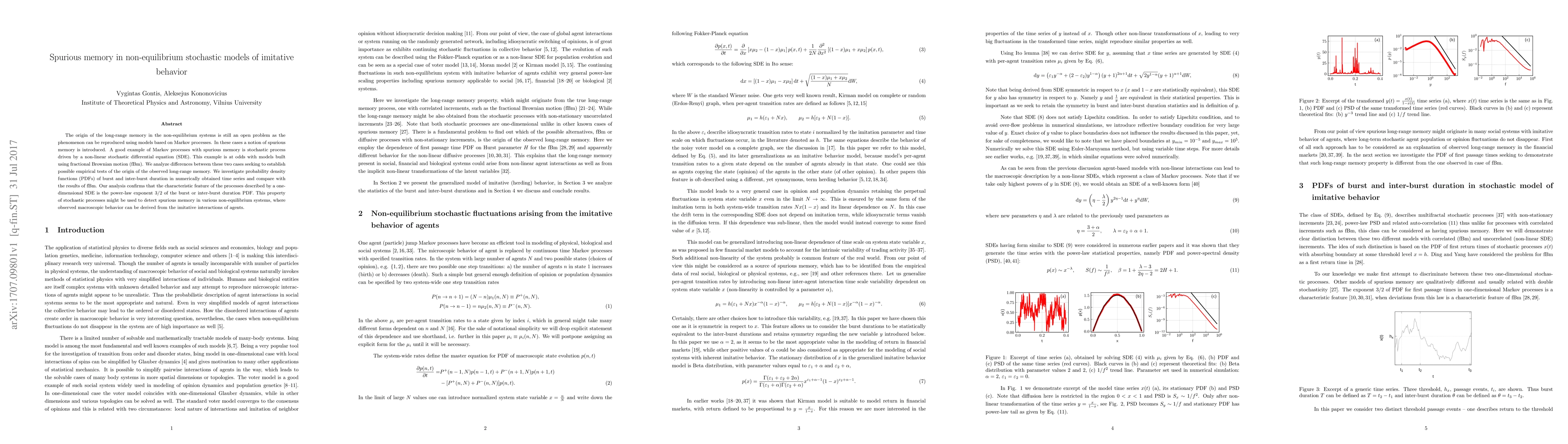

The origin of the long-range memory in the non-equilibrium systems is still an open problem as the phenomenon can be reproduced using models based on Markov processes. In these cases a notion of spurious memory is introduced. A good example of Markov processes with spurious memory is stochastic process driven by a non-linear stochastic differential equation (SDE). This example is at odds with models built using fractional Brownian motion (fBm). We analyze differences between these two cases seeking to establish possible empirical tests of the origin of the observed long-range memory. We investigate probability density functions (PDFs) of burst and inter-burst duration in numerically obtained time series and compare with the results of fBm. Our analysis confirms that the characteristic feature of the processes described by a one-dimensional SDE is the power-law exponent $3/2$ of the burst or inter-burst duration PDF. This property of stochastic processes might be used to detect spurious memory in various non-equilibrium systems, where observed macroscopic behavior can be derived from the imitative interactions of agents.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContrastive learning through non-equilibrium memory

Arvind Murugan, Benjamin Scellier, Martin Falk et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)