Authors

Summary

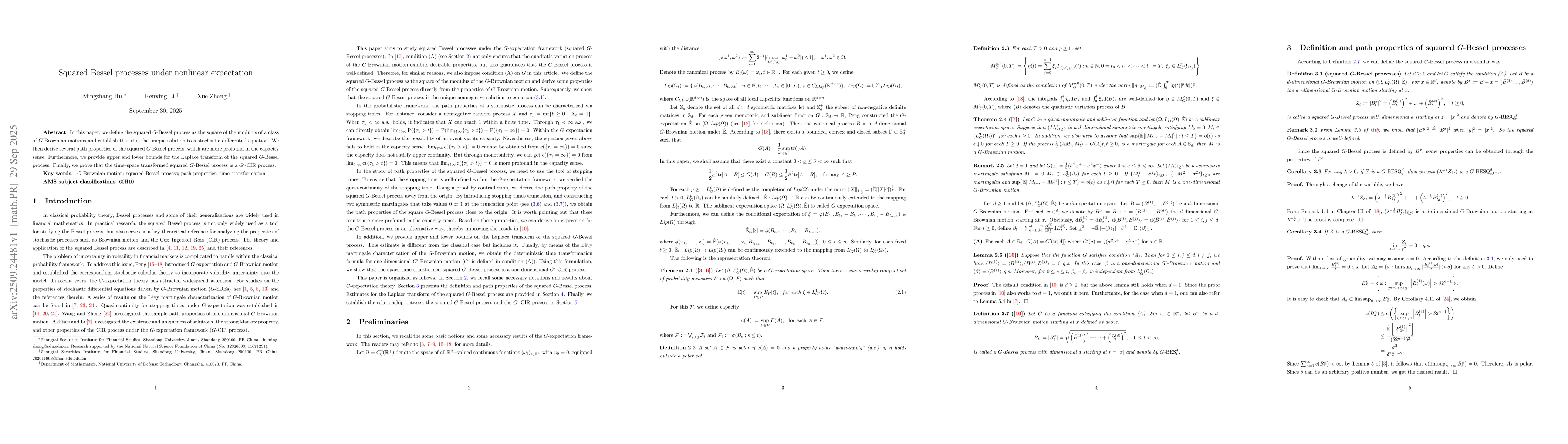

In this paper, we define the squared G-Bessel process as the square of the modulus of a class of G-Brownian motions and establish that it is the unique solution to a stochastic differential equation. We then derive several path properties of the squared G-Bessel process, which are more profound in the capacity sense. Furthermore, we provide upper and lower bounds for the Laplace transform of the squared G-Bessel process. Finally, we prove that the time-space transformed squared G-Bessel process is a G'-CIR process.

AI Key Findings

Generated Sep 30, 2025

Methodology

The research employs a combination of stochastic calculus, sublinear expectations, and martingale theory to analyze squared G-Bessel processes. It utilizes G-Brownian motion and its properties under non-linear expectations to derive key results about exit times, transformations, and relationships with CIR processes.

Key Results

- Established existence and properties of squared G-Bessel processes under G-expectation framework

- Derived transformation formulas connecting G-Bessel processes to G'-CIR processes

- Proven pathwise properties and martingale characterizations for G-Brownian motion

Significance

This work advances understanding of stochastic processes under uncertainty by providing rigorous mathematical frameworks for non-linear expectations. The results have potential applications in financial mathematics and risk analysis under volatility uncertainty.

Technical Contribution

Developed new transformation techniques between G-Bessel processes and CIR processes, and established martingale properties under G-expectation framework with rigorous mathematical proofs.

Novelty

Introduces a novel approach to relate squared G-Bessel processes with G'-CIR processes through time transformations, providing new insights into stochastic processes under non-linear expectations.

Limitations

- Results are primarily theoretical and require further empirical validation

- Assumptions about sublinear expectations may limit real-world applicability

Future Work

- Explore numerical methods for simulating G-Bessel processes

- Investigate applications in financial derivatives pricing under uncertainty

- Extend results to multi-dimensional G-Bessel processes

Comments (0)