Summary

This paper investigates the identification, the determinacy and the stability of ad hoc, "quasi-optimal" and optimal policy rules augmented with financial stability indicators (such as asset prices deviations from their fundamental values) and minimizing the volatility of the policy interest rates, when the central bank precommits to financial stability. Firstly, ad hoc and quasi-optimal rules parameters of financial stability indicators cannot be identified. For those rules, non zero policy rule parameters of financial stability indicators are observationally equivalent to rule parameters set to zero in another rule, so that they are unable to inform monetary policy. Secondly, under controllability conditions, optimal policy rules parameters of financial stability indicators can all be identified, along with a bounded solution stabilizing an unstable economy as in Woodford (2003), with determinacy of the initial conditions of non- predetermined variables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

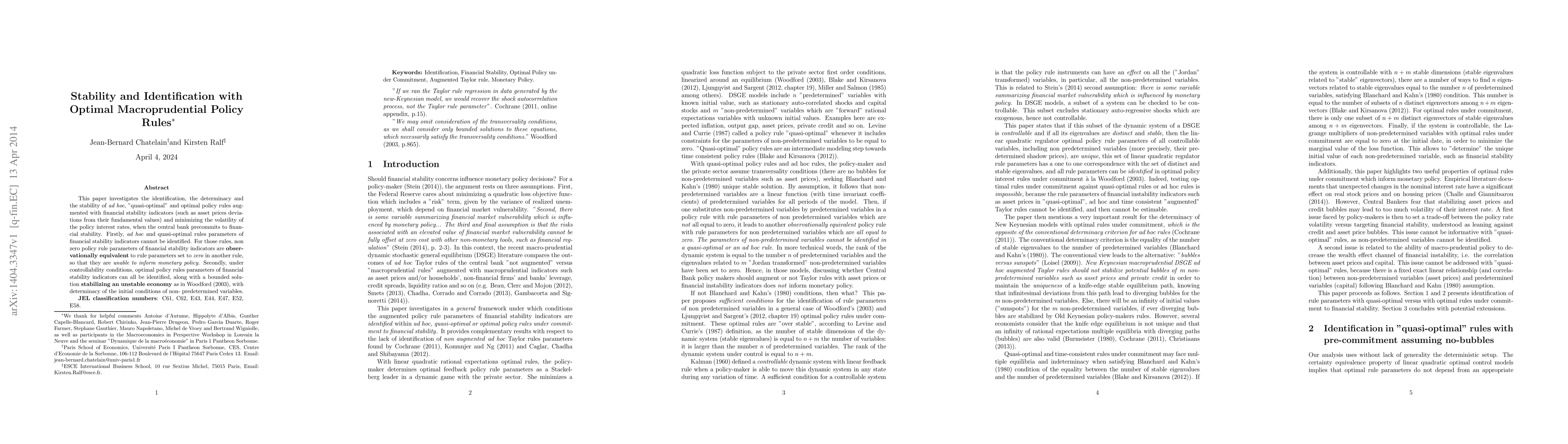

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)