Summary

Prices of European call options in a regime-switching local volatility model can be computed by solving a parabolic system which generalises the classical Black and Scholes equation, giving these prices as functionals of the local volatilities. We prove Lipschitz stability for the inverse problem of determining the local volatilities from quoted call option prices for a range of strikes, if the calls are indexed by the different states of the continuous Markov chain which governs the regime switches.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

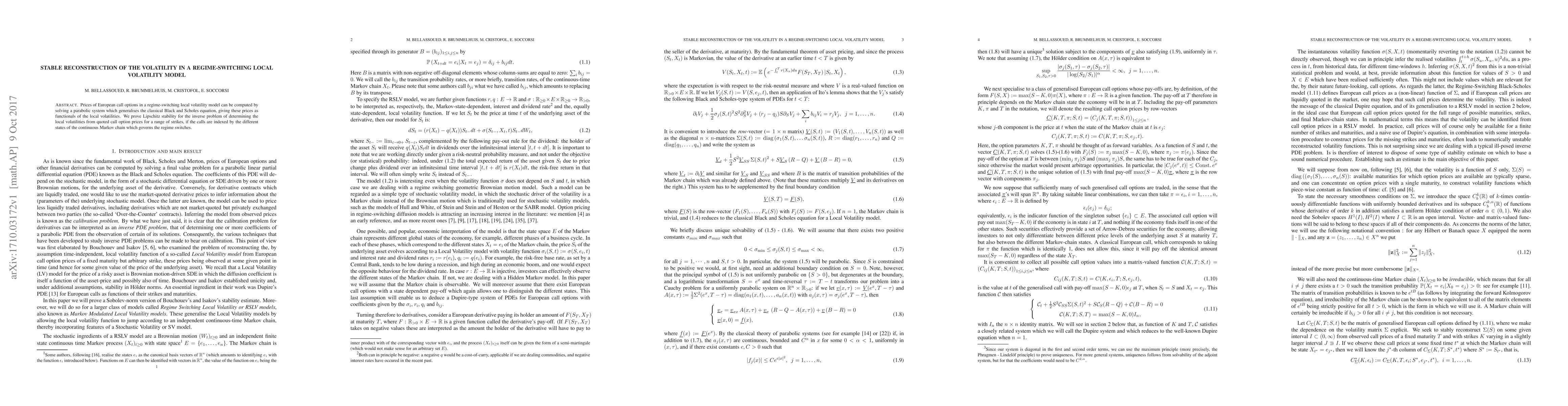

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)