Authors

Summary

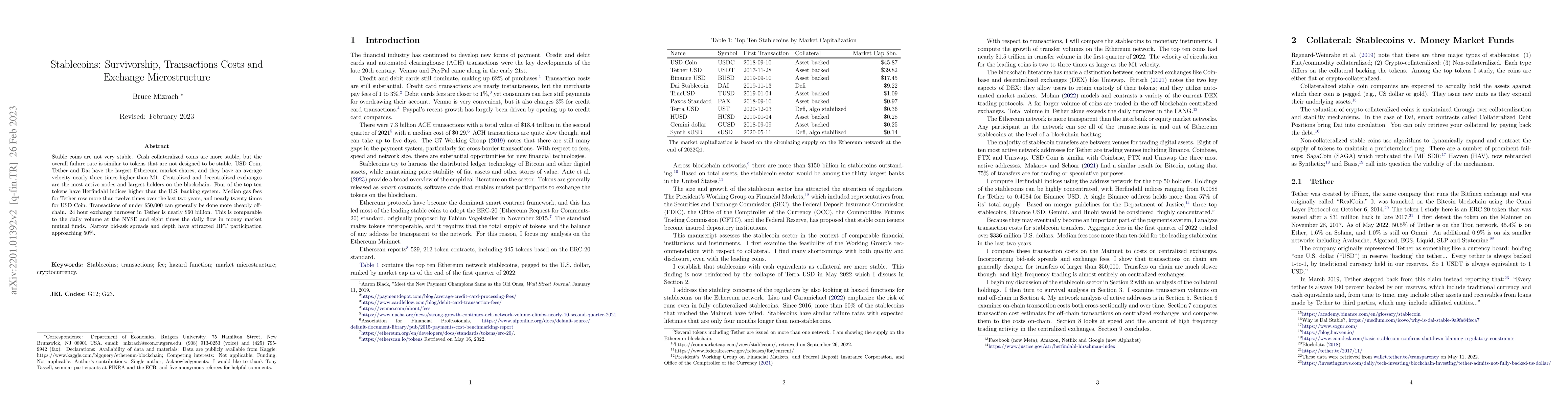

Stable coins are not very stable. Cash collateralized coins are more stable, but the overall failure rate is similar to tokens that are not designed to be stable. USD Coin, Tether and Dai have the largest Ethereum market shares, and they have an average velocity nearly three times higher than M1. Centralized and decentralized exchanges are the most active nodes and largest holders on the blockchain. Four of the top ten tokens have Herfindahl indices higher than the U.S. banking system. Median gas fees for Tether rose more than twelve times over the last two years, and nearly twenty times for USD Coin. Transactions of under 50,000 USD can generally be done more cheaply offchain. 24 hour exchange turnover in Tether is nearly 60 billion USD. This is comparable to the daily volume at the NYSE and eight times the daily flow in money market mutual funds. Narrow bid-ask spreads and depth have attracted HFT participation approaching 50%

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMStableChain: Towards Multi-Native Stablecoins in EVM-Compatible Blockchain for Stable Fee and Mass Adoption

Bo Gao, Mingzhe Li, Qingsong Wei et al.

Stablecoins: Fundamentals, Emerging Issues, and Open Challenges

Maurantonio Caprolu, Roberto Di Pietro, Ahmed Mahrous

Stablecoins and Central Bank Digital Currencies: Policy and Regulatory Challenges

Barry Eichengreen, Ganesh Viswanath-Natraj

| Title | Authors | Year | Actions |

|---|

Comments (0)