Authors

Summary

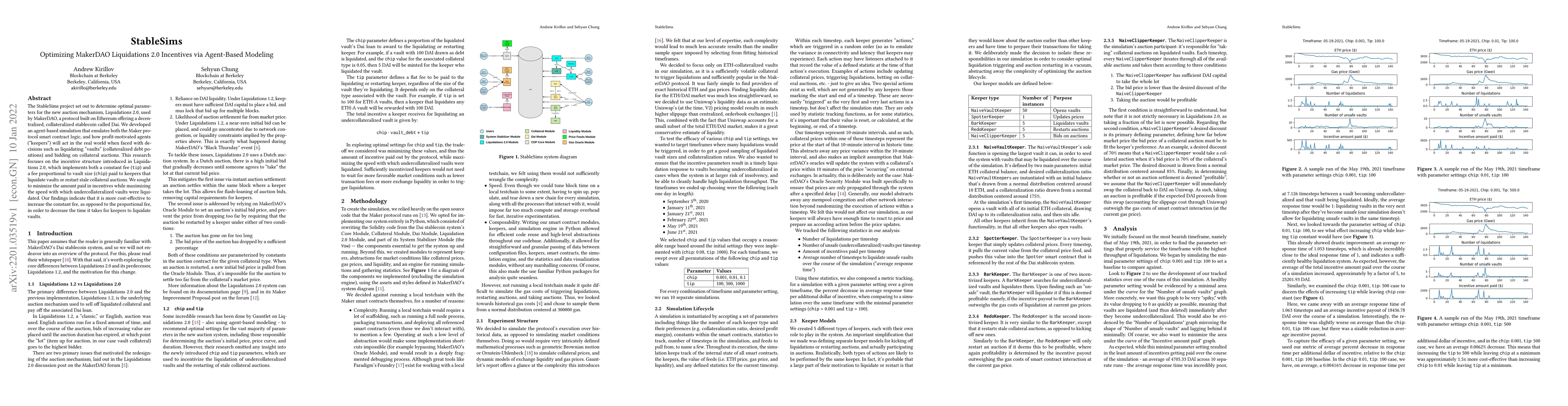

The StableSims project set out to determine optimal parameters for the new auction mechanism, Liquidations 2.0, used by MakerDAO, a protocol built on Ethereum offering a decentralized, collateralized stablecoin called Dai. We developed an agent-based simulation that emulates both the Maker protocol smart contract logic, and how profit-motivated agents ("keepers") will act in the real world when faced with decisions such as liquidating "vaults" (collateralized debt positions) and bidding on collateral auctions. This research focuses on the incentive structure introduced in Liquidations 2.0, which implements both a constant fee (tip) and a fee proportional to vault size (chip) paid to keepers that liquidate vaults or restart stale collateral auctions. We sought to minimize the amount paid in incentives while maximizing the speed with which undercollateralized vaults were liquidated. Our findings indicate that it is more cost-effective to increase the constant fee, as opposed to the proportional fee, in order to decrease the time it takes for keepers to liquidate vaults.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimizing Individualized Incentives from Grid Measurements and Limited Knowledge of Agent Behavior

Adam Lechowicz, Andrey Bernstein, Joshua Comden

| Title | Authors | Year | Actions |

|---|

Comments (0)