Summary

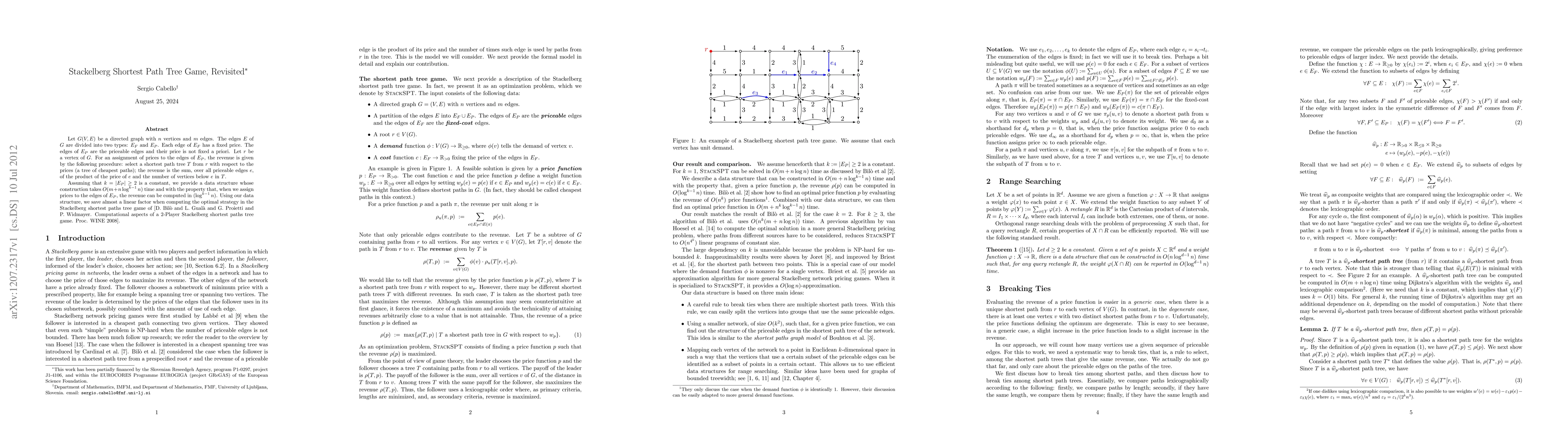

Let $G(V,E)$ be a directed graph with $n$ vertices and $m$ edges. The edges $E$ of $G$ are divided into two types: $E_F$ and $E_P$. Each edge of $E_F$ has a fixed price. The edges of $E_P$ are the priceable edges and their price is not fixed a priori. Let $r$ be a vertex of $G$. For an assignment of prices to the edges of $E_P$, the revenue is given by the following procedure: select a shortest path tree $T$ from $r$ with respect to the prices (a tree of cheapest paths); the revenue is the sum, over all priceable edges $e$, of the product of the price of $e$ and the number of vertices below $e$ in $T$. Assuming that $k=|E_P|\ge 2$ is a constant, we provide a data structure whose construction takes $O(m+n\log^{k-1} n)$ time and with the property that, when we assign prices to the edges of $E_P$, the revenue can be computed in $(\log^{k-1} n)$. Using our data structure, we save almost a linear factor when computing the optimal strategy in the Stackelberg shortest paths tree game of [D. Bil{\`o} and L. Gual{\`a} and G. Proietti and P. Widmayer. Computational aspects of a 2-Player Stackelberg shortest paths tree game. Proc. WINE 2008].

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)