Authors

Summary

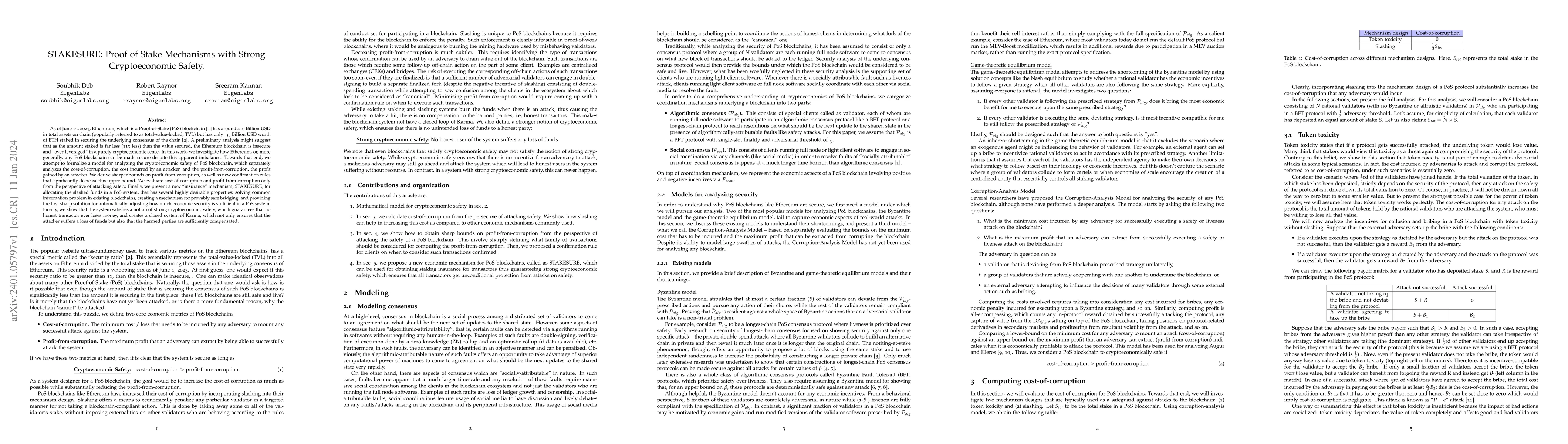

As of July 15, 2023, Ethererum, which is a Proof-of-Stake (PoS) blockchain [1] has around 410 Billion USD in total assets on chain (popularly referred to as total-value-locked, TVL) but has only 33 Billion USD worth of ETH staked in securing the underlying consensus of the chain [2]. A preliminary analysis might suggest that as the amount staked is far less (11x less) than the value secured, the Ethereum blockchain is insecure and "over-leveraged" in a purely cryptoeconomic sense. In this work, we investigate how Ethereum, or, more generally, any PoS blockchain can be made secure despite this apparent imbalance. Towards that end, we attempt to formalize a model for analyzing the cryptoeconomic safety of PoS blockchain, which separately analyzes the cost-of-corruption, the cost incurred by an attacker, and the profit-from-corruption, the profit gained by an attacker. We derive sharper bounds on profit-from-corruption, as well as new confirmation rules that significantly decrease this upper-bound. We evaluate cost-of-corruption and profit-from-corruption only from the perspective of attacking safety. Finally, we present a new "insurance" mechanism, STAKESURE, for allocating the slashed funds in a PoS system, that has several highly desirable properties: solving common information problem in existing blockchains, creating a mechanism for provably safe bridging, and providing the first sharp solution for automatically adjusting how much economic security is sufficient in a PoS system. Finally, we show that the system satisfies a notion of strong cryptoeconomic safety, which guarantees that no honest transactor ever loses money, and creates a closed system of Karma, which not only ensures that the attacker suffers a loss of funds but also that the harmed parties are sufficiently compensated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBabylon: Reusing Bitcoin Mining to Enhance Proof-of-Stake Security

Fisher Yu, Sreeram Kannan, David Tse et al.

Proof-of-Stake Mining Games with Perfect Randomness

Matheus V. X. Ferreira, S. Matthew Weinberg

| Title | Authors | Year | Actions |

|---|

Comments (0)