Summary

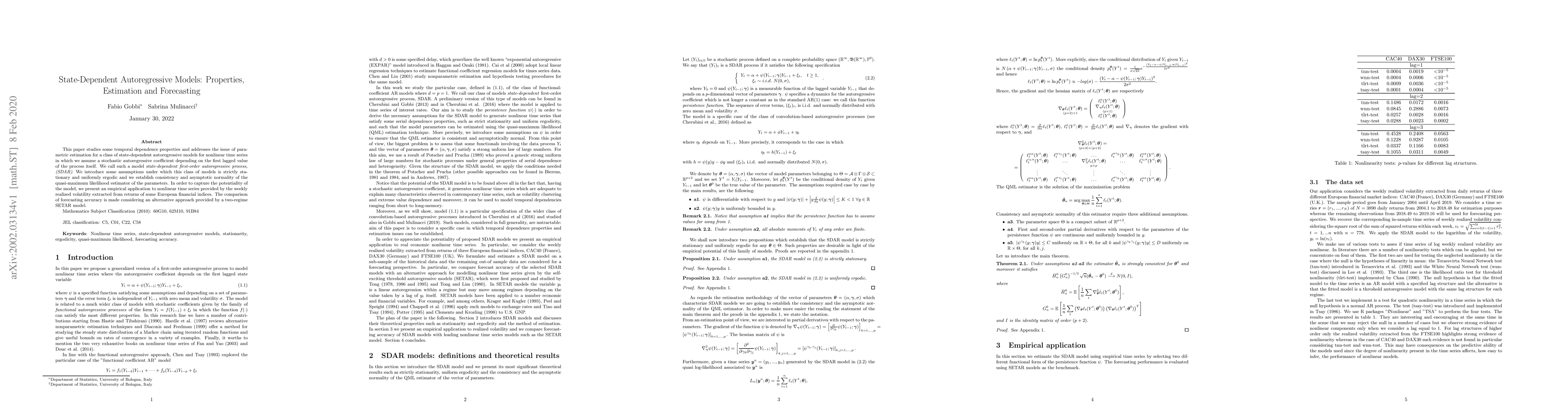

This paper studies some temporal dependence properties and addresses the issue of parametric estimation for a class of state-dependent autoregressive models for nonlinear time series in which we assume a stochastic autoregressive coefficient depending on the first lagged value of the process itself. We call such a model state-dependent first-order autoregressive process, (SDAR). We introduce some assumptions under which this class of models is strictly stationary and uniformly ergodic and we establish consistency and asymptotic normality of the quasi-maximum likelihood estimator of the parameters. In order to capture the potentiality of the model, we present an empirical application to nonlinear time series provided by the weekly realized volatility extracted from returns of some European financial indices. The comparison of forecasting accuracy is made considering an alternative approach provided by a two-regime SETAR model

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBivariate generalized autoregressive models for forecasting bivariate non-Gaussian times series

Fábio M. Bayer, Tatiane Fontana Ribeiro, Airlane P. Alencar

| Title | Authors | Year | Actions |

|---|

Comments (0)