Summary

This paper develops an inferential theory for state-varying factor models of large dimensions. Unlike constant factor models, loadings are general functions of some recurrent state process. We develop an estimator for the latent factors and state-varying loadings under a large cross-section and time dimension. Our estimator combines nonparametric methods with principal component analysis. We derive the rate of convergence and limiting normal distribution for the factors, loadings and common components. In addition, we develop a statistical test for a change in the factor structure in different states. We apply the estimator to U.S. Treasury yields and S&P500 stock returns. The systematic factor structure in treasury yields differs in times of booms and recessions as well as in periods of high market volatility. State-varying factors based on the VIX capture significantly more variation and pricing information in individual stocks than constant factor models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

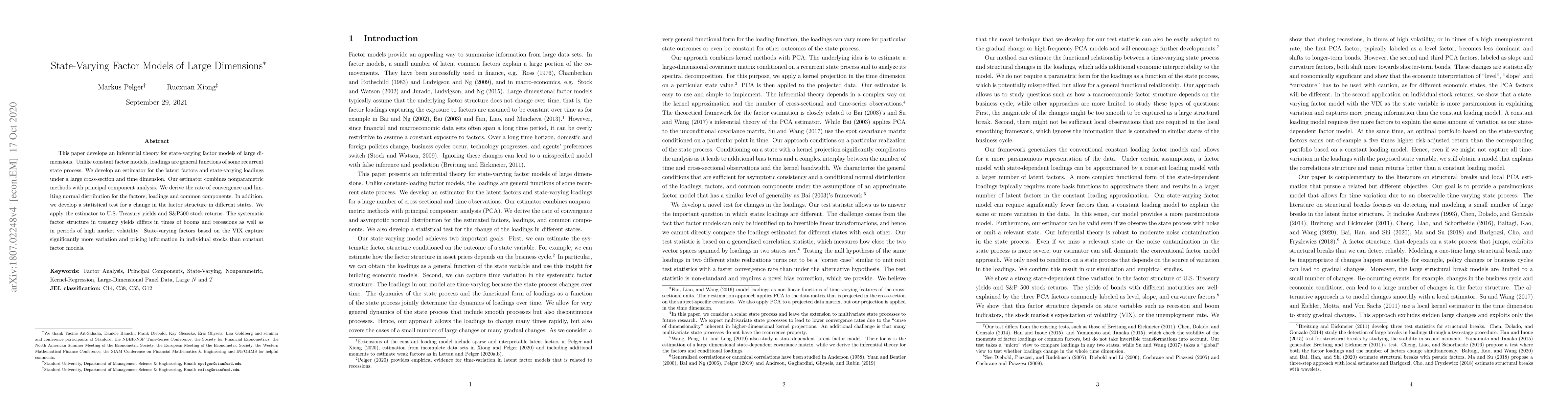

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)