Authors

Summary

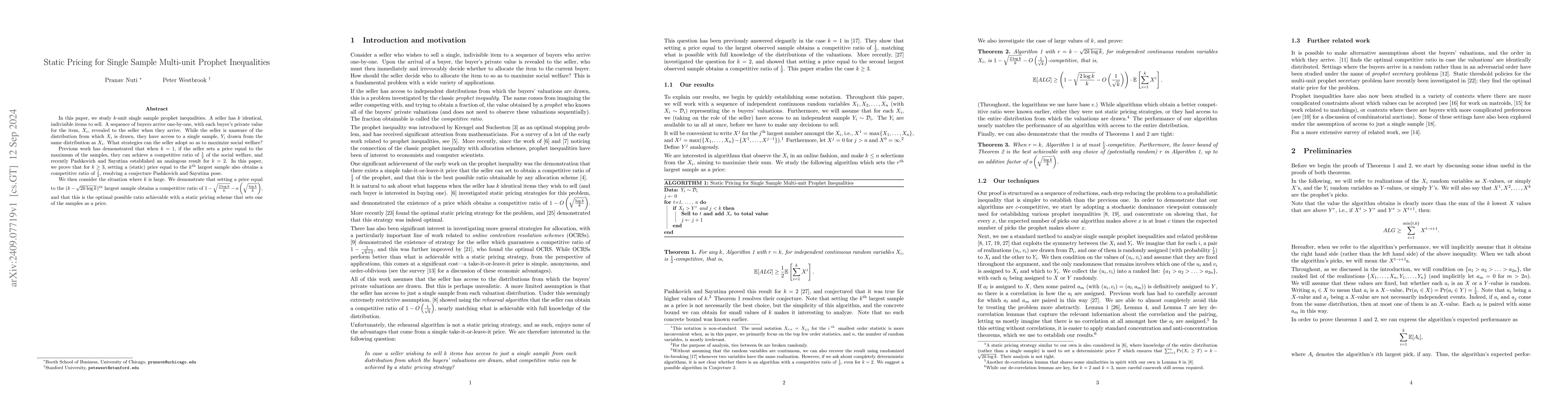

In this paper, we study $k$-unit single sample prophet inequalities. A seller has $k$ identical, indivisible items to sell. A sequence of buyers arrive one-by-one, with each buyer's private value for the item, $X_i$, revealed to the seller when they arrive. While the seller is unaware of the distribution from which $X_i$ is drawn, they have access to a single sample, $Y_i$ drawn from the same distribution as $X_i$. What strategies can the seller adopt so as to maximize social welfare? Previous work has demonstrated that when $k = 1$, if the seller sets a price equal to the maximum of the samples, they can achieve a competitive ratio of $\frac{1}{2}$ of the social welfare, and recently Pashkovich and Sayutina established an analogous result for $k = 2$. In this paper, we prove that for $k \geq 3$, setting a (static) price equal to the $k^{\text{th}}$ largest sample also obtains a competitive ratio of $\frac{1}{2}$, resolving a conjecture Pashkovich and Sayutina pose. We then consider the situation where $k$ is large. We demonstrate that setting a price equal to the $(k-\sqrt{2k\log k})^{\text{th}}$ largest sample obtains a competitive ratio of $1 - \sqrt{\frac{2\log k}{k}} - o\left(\sqrt{\frac{\log k}{k}}\right)$, and that this is the optimal possible ratio achievable with a static pricing scheme that sets one of the samples as a price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStatic pricing for multi-unit prophet inequalities

Thodoris Lykouris, Shuchi Chawla, Nikhil Devanur

Multi-Unit Combinatorial Prophet Inequalities

Yifan Wang, Zhiyi Huang, Trung Dang et al.

No citations found for this paper.

Comments (0)