Authors

Summary

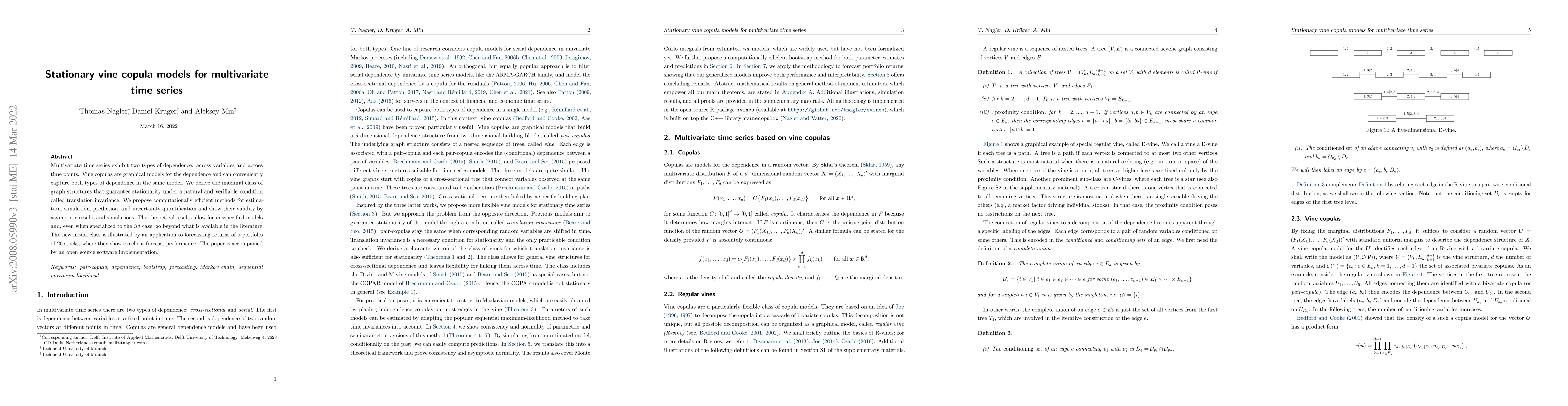

Multivariate time series exhibit two types of dependence: across variables and across time points. Vine copulas are graphical models for the dependence and can conveniently capture both types of dependence in the same model. We derive the maximal class of graph structures that guarantee stationarity under a natural and verifiable condition called translation invariance. We propose computationally efficient methods for estimation, simulation, prediction, and uncertainty quantification and show their validity by asymptotic results and simulations. The theoretical results allow for misspecified models and, even when specialized to the iid case, go beyond what is available in the literature. Their proofs are based on new results for general semiparametric method-of-moment estimators, which shall be of independent interest. The new model class is illustrated by an application to forecasting returns of a portfolio of 20 stocks, where they show excellent forecast performance. The paper is accompanied by an open source software implementation.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)