Summary

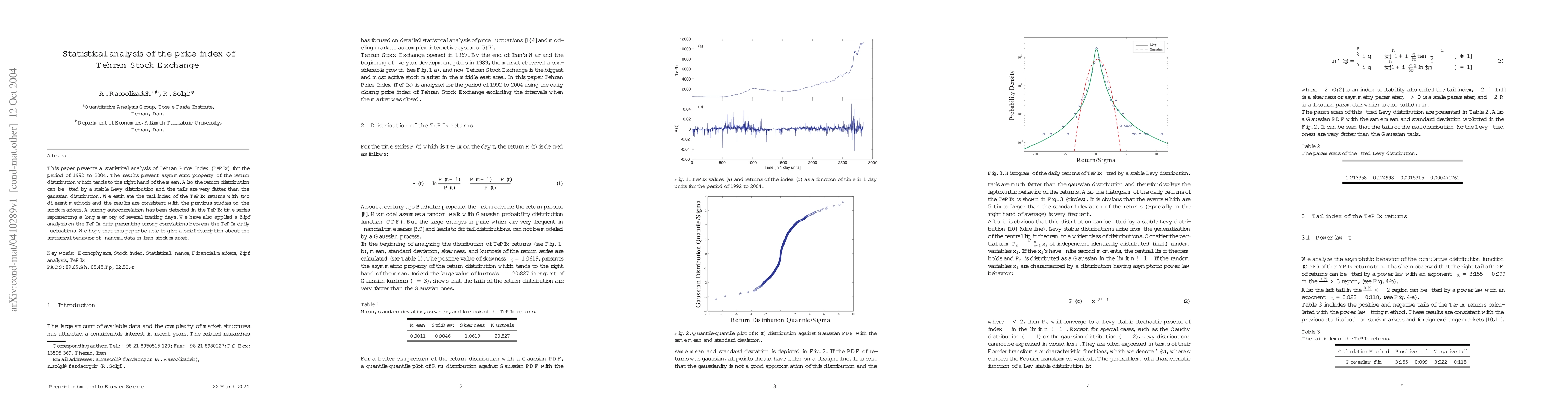

This paper presents a statistical analysis of Tehran Price Index (TePIx) for the period of 1992 to 2004. The results present asymmetric property of the return distribution which tends to the right hand of the mean. Also the return distribution can be fitted by a stable Levy distribution and the tails are very fatter than the gaussian distribution. We estimate the tail index of the TePIx returns with two different methods and the results are consistent with the previous studies on the stock markets. A strong autocorrelation has been detected in the TePIx time series representing a long memory of several trading days. We have also applied a Zipf analysis on the TePIx data presenting strong correlations between the TePIx daily fluctuations. We hope that this paper be able to give a brief description about the statistical behavior of financial data in Iran stock market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)