Authors

Summary

Equity market dynamics are conventionally investigated in name space where stocks are indexed by company names. In contrast, by indexing stocks based on their ranks in capitalization, we gain a different perspective of market dynamics in rank space. Here, we demonstrate the superior performance of statistical arbitrage in rank space over name space, driven by a robust market representation and enhanced mean-reverting properties of residual returns in rank space. Our statistical arbitrage algorithm features an intraday rebalancing mechanism for effective conversion between portfolios in name and rank space. We explore statistical arbitrage with and without neural networks in both name and rank space and show that the portfolios obtained in rank space with neural networks significantly outperform those in name space.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

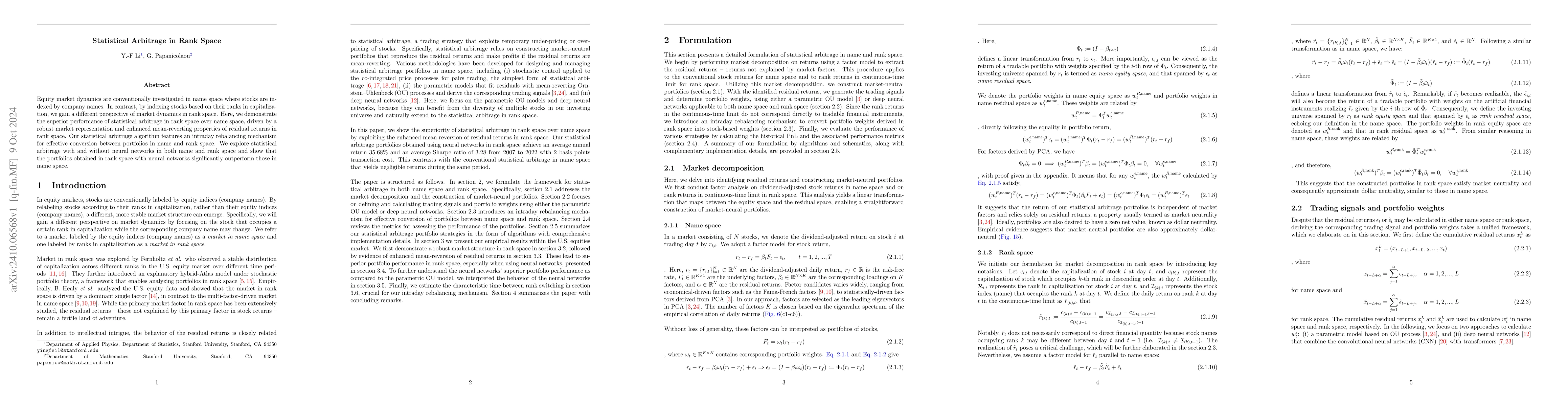

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Learning Statistical Arbitrage

Markus Pelger, Greg Zanotti, Jorge Guijarro-Ordonez

Advanced Statistical Arbitrage with Reinforcement Learning

Boming Ning, Kiseop Lee

No citations found for this paper.

Comments (0)