Summary

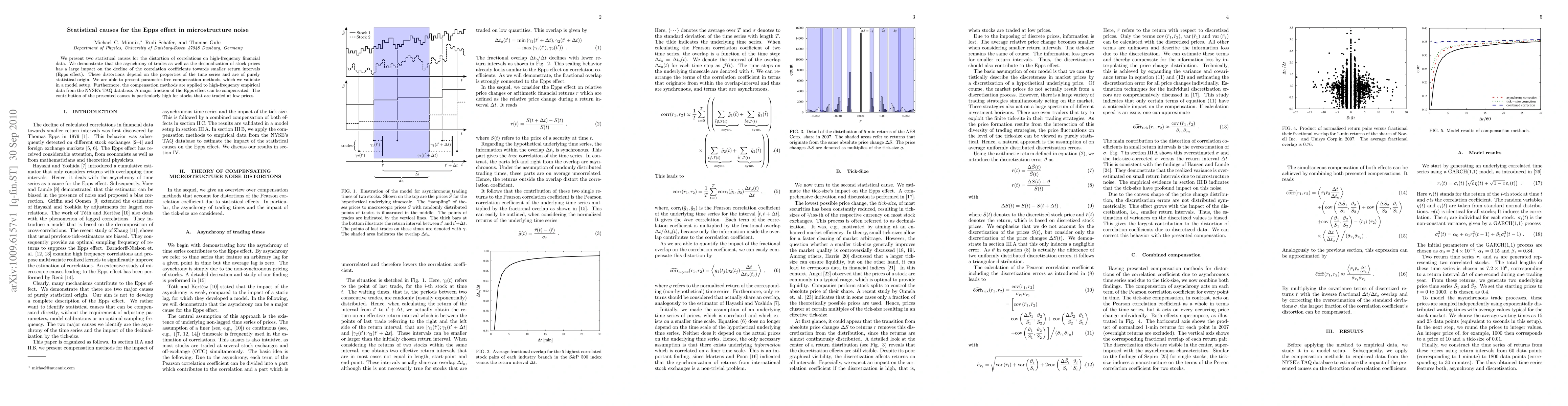

We present two statistical causes for the distortion of correlations on high-frequency financial data. We demonstrate that the asynchrony of trades as well as the decimalization of stock prices has a large impact on the decline of the correlation coefficients towards smaller return intervals (Epps effect). These distortions depend on the properties of the time series and are of purely statistical origin. We are able to present parameter-free compensation methods, which we validate in a model setup. Furthermore, the compensation methods are applied to high-frequency empirical data from the NYSE's TAQ database. A major fraction of the Epps effect can be compensated. The contribution of the presented causes is particularly high for stocks that are traded at low prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)