Authors

Summary

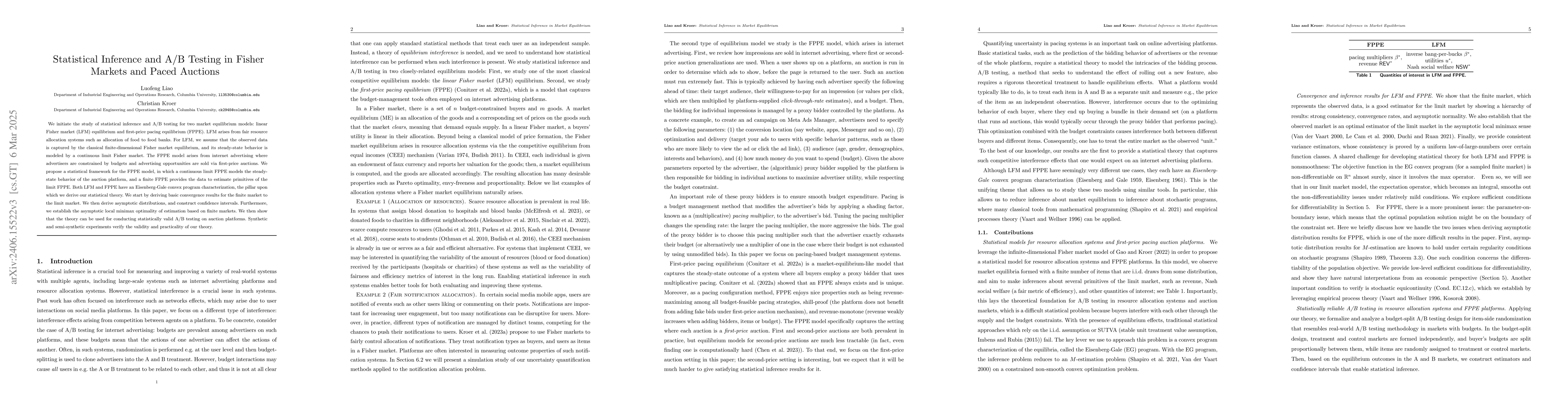

We initiate the study of statistical inference and A/B testing for two market equilibrium models: linear Fisher market (LFM) equilibrium and first-price pacing equilibrium (FPPE). LFM arises from fair resource allocation systems such as allocation of food to food banks and notification opportunities to different types of notifications. For LFM, we assume that the data observed is captured by the classical finite-dimensional Fisher market equilibrium, and its steady-state behavior is modeled by a continuous limit Fisher market. The second type of equilibrium we study, FPPE, arises from internet advertising where advertisers are constrained by budgets and advertising opportunities are sold via first-price auctions. For platforms that use pacing-based methods to smooth out the spending of advertisers, FPPE provides a hindsight-optimal configuration of the pacing method. We propose a statistical framework for the FPPE model, in which a continuous limit FPPE models the steady-state behavior of the auction platform, and a finite FPPE provides the data to estimate primitives of the limit FPPE. Both LFM and FPPE have an Eisenberg-Gale convex program characterization, the pillar upon which we derive our statistical theory. We start by deriving basic convergence results for the finite market to the limit market. We then derive asymptotic distributions, and construct confidence intervals. Furthermore, we establish the asymptotic local minimax optimality of estimation based on finite markets. We then show that the theory can be used for conducting statistically valid A/B testing on auction platforms. Synthetic and semi-synthetic experiments verify the validity and practicality of our theory.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersStatistical Inference for Fisher Market Equilibrium

Yuan Gao, Luofeng Liao, Christian Kroer

Statistical Inference and A/B Testing for First-Price Pacing Equilibria

Luofeng Liao, Christian Kroer

Default Supply Auctions in Electricity Markets: Challenges and Proposals

Juan Ignacio Peña, Rosa Rodriguez

No citations found for this paper.

Comments (0)