Summary

We study statistical properties of the optimal value and optimal solutions of the Sample Average Approximation of risk averse stochastic problems. Central Limit Theorem type results are derived for the optimal value and optimal solutions when the stochastic program is expressed in terms of a law invariant coherent risk measure. The obtained results are applied to hypotheses testing problems aiming at comparing the optimal values of several risk averse convex stochastic programs on the basis of samples of the underlying random vectors. We also consider non-asymptotic tests based on confidence intervals on the optimal values of the stochastic programs obtained using the Stochastic Mirror Descent algorithm. Numerical simulations show how to use our developments to choose among different distributions and show the superiority of the asymptotic tests on a class of risk averse stochastic programs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

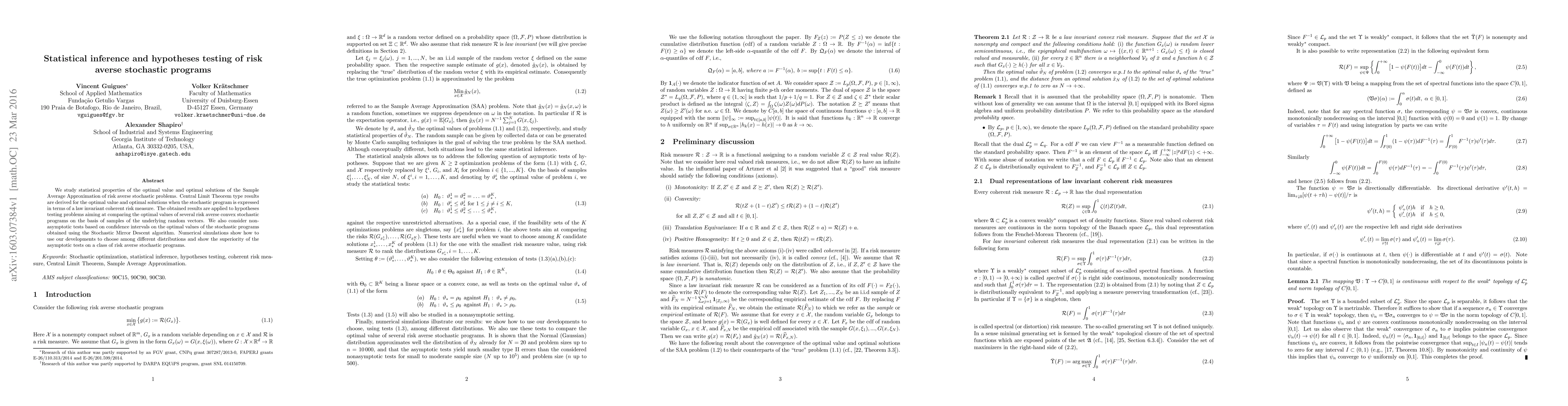

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDual SDDP for risk-averse multistage stochastic programs

Vincent Leclère, Bernardo Freitas Paulo da Costa

Assessing solution quality in risk-averse stochastic programs

Nick W. Koning, E. Ruben van Beesten, David P. Morton

Risk-Averse Stochastic Optimal Control: an efficiently computable statistical upper bound

Yi Cheng, Alexander Shapiro, Vincent Guigues

| Title | Authors | Year | Actions |

|---|

Comments (0)