Summary

Mediation analysis draws increasing attention in many scientific areas such as genomics, epidemiology and finance. In this paper, we propose new statistical inference procedures for high dimensional mediation models, in which both the outcome model and the mediator model are linear with high dimensional mediators. Traditional procedures for mediation analysis cannot be used to make statistical inference for high dimensional linear mediation models due to high-dimensionality of the mediators. We propose an estimation procedure for the indirect effects of the models via a partial penalized least squares method, and further establish its theoretical properties. We further develop a partial penalized Wald test on the indirect effects, and prove that the proposed test has a $\chi^2$ limiting null distribution. We also propose an $F$-type test for direct effects and show that the proposed test asymptotically follows a $\chi^2$-distribution under null hypothesis and a noncentral $\chi^2$-distribution under local alternatives. Monte Carlo simulations are conducted to examine the finite sample performance of the proposed tests and compare their performance with existing ones. We further apply the newly proposed statistical inference procedures to study stock reaction to COVID-19 pandemic via an empirical analysis of studying the mediation effects of financial metrics that bridge company's sector and stock return.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

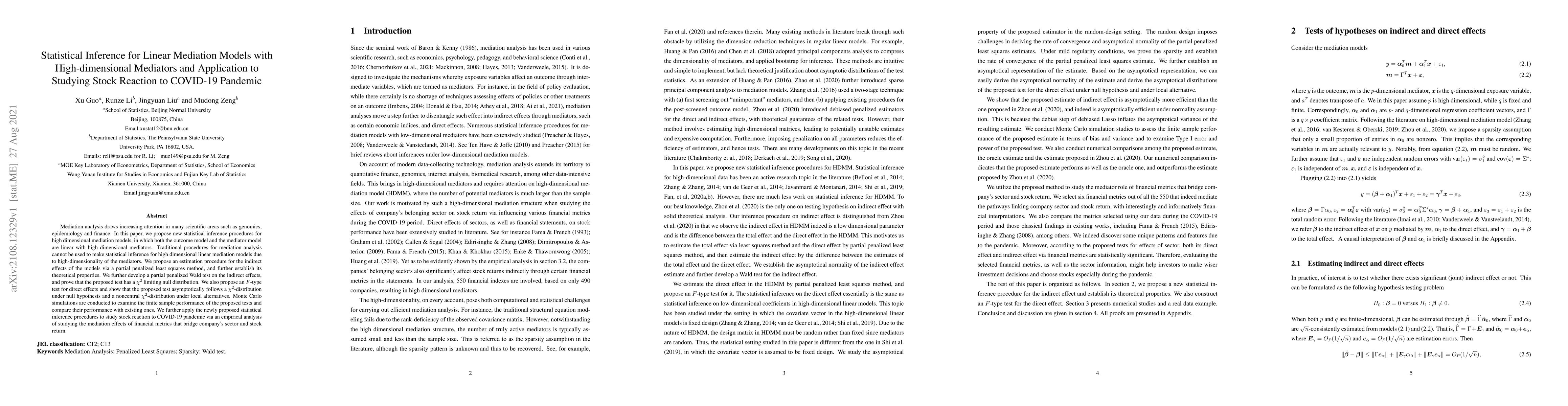

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)