Summary

We consider structural credit modeling in the important special case where the log-leverage ratio of the firm is a time-changed Brownian motion (TCBM) with the time-change taken to be an independent increasing process. Following the approach of Black and Cox, one defines the time of default to be the first passage time for the log-leverage ratio to cross the level zero. Rather than adopt the classical notion of first passage, with its associated numerical challenges, we accept an alternative notion applicable for TCBMs called "first passage of the second kind". We demonstrate how statistical inference can be efficiently implemented in this new class of models. This allows us to compare the performance of two versions of TCBMs, the variance gamma (VG) model and the exponential jump model (EXP), to the Black-Cox model. When applied to a 4.5 year long data set of weekly credit default swap (CDS) quotes for Ford Motor Co, the conclusion is that the two TCBM models, with essentially one extra parameter, can significantly outperform the classic Black-Cox model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

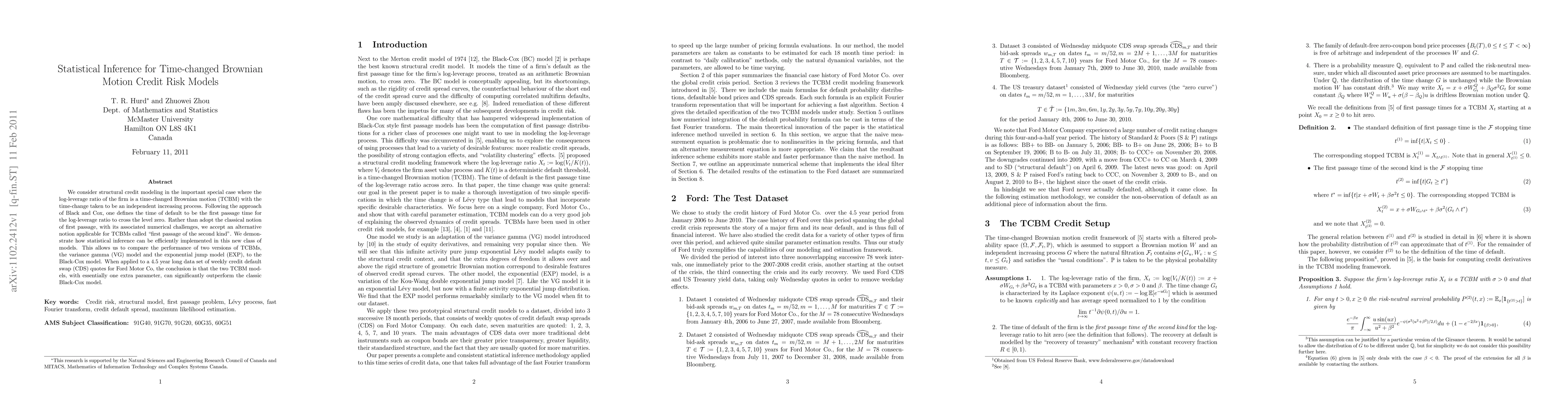

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)