Summary

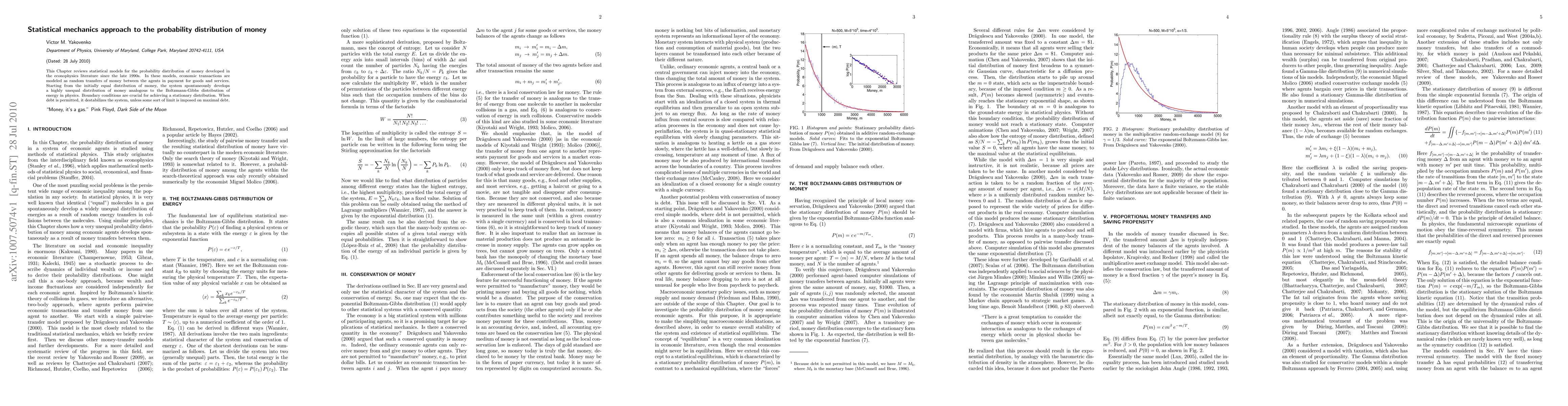

This Chapter reviews statistical models for the probability distribution of money developed in the econophysics literature since the late 1990s. In these models, economic transactions are modeled as random transfers of money between the agents in payment for goods and services. Starting from the initially equal distribution of money, the system spontaneously develops a highly unequal distribution of money analogous to the Boltzmann-Gibbs distribution of energy in physics. Boundary conditions are crucial for achieving a stationary distribution. When debt is permitted, it destabilizes the system, unless some sort of limit is imposed on maximal debt.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)